|

State-owned

bank also hires foreign CEOs

Though

foreign CEOs are commonly seen in privately run commercial banks, few banks

where the state holds the controlling stake employ foreigners.

Vietcombank appointed the first foreign employee in its history

In October 2017, Vietcombank

appointed the first foreign employee in the bank’s history. Thomas William

Tobin from Visa International is director of the bank’s Retail Banking

division.

Tobin is not a stranger to the Vietnamese finance market. He once held the post of CEO of HSBC Vietnam in 2006 and under his management, HSBC became the first foreign bank to set up a subsidiary in In 2011, he left for Visa International and his seat was taken over by Sumit Dutta, who was director of Personal Finance Service division at Techcombank, a private bank. Commenting about Vietcombank’s appointment, analysts said state-owned banks, which are more ‘conservative’ than private banks, are now more open but Vietcombank remains the only state-owned bank to hire foreign staff.

Among

state-owned banks, BIDV (the Bank for Investment & development of

Pham Quang Tung, chair of the Vietnam Development Bank (VDB), which specializes in providing loans to serve the government’s development projects, works at BIDV. But it is still unclear what his position is. The business performance indexes of BIDV and VietinBank are not as good as Vietcombank’s. In the first nine months of 2017, BIDV’s net interest margin increased significantly by 37.7 percent, higher than Vietcombank’s 18.4 percent and VietinBank’s 15.8 percent, but its post-tax profit growth rate was in the minus figures. This was attributed to the high provisions against bad debts BIDV had to make. The bad debts of third, fourth and fifth groups increased by 19.5 percent compared with the same period last year. The three banks have been trying to develop retail banking services while they have focused on wholesale in the past. Developing retail banking is in fashion now, which, according to PwC, will be one of the five hottest growing sectors in the time to come. Vietcombank’s chair Nghiem Xuan Thanh said qualified high personnel will play an important role in the bank’s path of retail banking. He said the appointment of a foreign worker with experience and deep knowledge about the Vietnamese market to the post of director of retail banking shows the bank’s determination to become No 1 in retail banking in

Kim Chi, VNN

|

Thứ Tư, 31 tháng 1, 2018

|

Prime Minister Nguyen Xuan Phuc has asked the Ministry of Industry

and Trade to double check goods exported to the

The

PM emphasized that special attention should be paid to products using

materials and components imported from

According

to the General Department of Vietnam Customs, in 2017 Vietnam’s exports to

the US increased by 8.2% to US$41.61 billion compared to the previous year,

including US$3.58 billion in December.

Last

year,

Besides,

products which earned an export value of more than US$1 billion each included

machines, equipment and tools (US$2.43 billion), seafood (US$1.41 billion),

bags, wallets, suitcases, hats and umbrellas (US$1.34 billion), cashew nuts

(US$1.22 billion) and means of transport and spare parts (US$1.18 billion).

It’s

noteworthy that the growth rate seems to slowdown in recent years, evidenced

by the growth rate dropping from 15% in 2016 to 8.2% in 2017 due to anti-dumping

and anti-subsidy measures as well as new policies hindering Vietnamese

exporters from entering the market.

Typically,

the

Seafood

exports to the market are forecast to face more difficulties as the origin of

exported products have been strictly monitored due to the implementation of

the Seafood Import Monitoring Program (SIMP) to prevent illegal, unreported

and unregulated (IUU)-caught and/or misrepresented seafood from entering US

commerce since early this year.

VOV

|

|

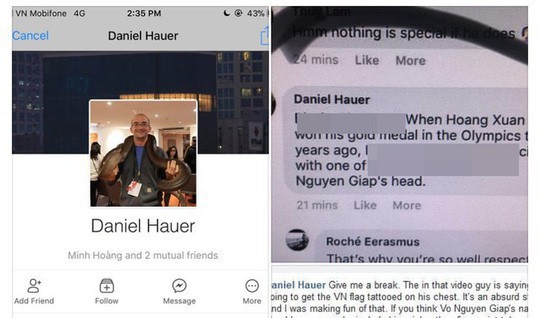

American teacher Daniel Hauer admitted his deep repentance over a

comment that referenced

Daniel Hauer and

his comment related to General Vo Nguyen Giap on Facebook

Daniel

Hauer was summoned by the Authority of Broadcasting and Electronic

Information to a meeting on January 30 to discuss his comments.

At

the meeting, Hauer said that his comment was intended to be just a joke which

had not aimed to insult General Giap, but he later recognised how serious his

comment had been taken. He said he was really sorry for his remark and wanted

to convey his apology to General Giap’s family and the public.

He

added that he felt ashamed for what he had done and this was a big lesson for

him. He hoped he could make up for the mistake. He wanted to continue sharing

his English knowledge with Vietnamese people and this is a way for him to

correct his mistake.

Hauer

hoped he could visit General Giap’s house to light incense for him.

According

to Hauer’s wife Le Thi Hau, she was really shocked to see her husband’s

comment on General Giap. She also claimed she was upset by this. She said she

explained to her husband about the problems over his comments.

Deputy

head of the Radio, Television and Electronic Information Department Le Quang

Tu said under Decree 174/2013/ND-CP, any person who distorts Vietnamese

history, denies the nation’s revolutionary achievements or disrespects

national heroes can be fined VND35-50 million (USD1,263-2,272). However,

authorities decided to postpone a fine on Hauer based on how repentant he is.

English

centres in

Dtinews

|

|

BUSINESS IN

BRIEF 31/1

Vinachem to accelerate apatite projects

The

Viet Nam Chemical National Group (Vinachem) will focus on investment of

apatite exploitation projects this year, said the group’s deputy general

director Bui The Chuyen.

Chuyen

said the group would accelerate completing procedures to get licences for

apatite projects such as mines 18, 19, Ngoi Dum Dong Ho, Cam Duong 2 and mine

26 of Apatite Viet Nam One Member Limited Company.

Vinachem

will resolve material issues to implement the expansion project of Bac Nhac

Son Apatite Ore Plant in the northern mountainous

In

addition, Vinachem will quickly complete investment preparation for improving

the quality of NPK Fertiliser Plant of Binh Dien Fertiliser Company in

southern Long An Province, with a total capacity of 200,000 tonnes a year,

Chuyen said.

According

to Vinachem’s report, production and trading of the Apatite Viet Nam One

Member Limited Company is faced with difficulties as the licence for apatite

exploitation at its mines has not been granted for a long time.

On

the other hand, its rivals have lowered prices to gain market shares, a

pressure tactic. This is one of the reasons why the company’s business

results have not met its expectation.

Last

year, its output reached 2.8 million tonnes, posting a 2.8 per cent

year-on-year increase and an increase of 6 per cent over the set target.

Its

apatite consumption reached 2.9 million tonnes, increasing 19 per cent from

the set target and 3.4 per cent from the previous year. The company’s revenue

was VND3.64 trillion (US$160 million), increasing by 2 per cent over the set

target and reducing by 7.3 per cent compared to 2016.

Nguyen

Tien Cuong, general director of the Apatite Viet Nam One Member Limited

Company, said its financial results last year did not meet the set targets

due to low prices, although its output and consumption surpassed targets.

The

company contributed VND566.6 billion to the State budget and posted a pre-tax

profit of VND150 billion.

Cuong

said the company has been seeking new export markets as well as continuing

its restructuring to improve financial supervision.

Digiworld looks to foray into FMCG sector

Digiworld

Corporation has said it will make a foray into the fast-moving consumer goods

(FMCG) and healthcare products markets this year.

Digiworld

plans to offer new products in the healthcare sector later this year. The

FMCG and healthcare sectors are expected to create new streams of revenue for

the company.

In

quarter three, Digiworld Venture Co Ltd, an arm of Digiworld Corporation,

acquired a 50.3% stake in CL Co Ltd, a local FMCG supplier which has a goods

distribution system across the country. The deal is expected to help

Digiworld venture into the FMCG market.

The

corporation made VND3.82 trillion (US$168.2 million) in revenue, and over

VND78 billion (US$3.4 million) in after-tax profit last year, beating its

full-year targets. In quarter four alone, its revenue amounted to VND1.12

trillion, a year-on-year rise of 11.3%.

Digiworld

general director Doan Hong Viet told reporters in HCMC on January 24 that the

corporation expects stronger growth in revenue from cell phones this year, at

roughly 60%. Notably, sales of cell phones like Xiaomi and Sharp have become

major revenue sources for the firm.

SBV asks banks to prioritize loans for production and business

The

State Bank of Vietnam (SBV) has told local banks and foreign bank branches to

increase lending to production and business activities, according to a Thoi

Bao Ngan Hang newspaper report.

SBV

governor Le Minh Hung asked banking institutions to strictly control their

credit growth in line with their assigned targets and the central bank’s

monetary policy.

Credit

growth and quality should go hand in hand, he said. Loan assessment and

supervision should be properly done to minimize non-performing loans, and

guarantee safety for the banking system.

Loans

for the real estate and construction sectors should be put under control.

Lender banks should monitor the progress of the property projects to which

they have lent, and check their clients’ financial capability,

creditworthiness and assets used as collateral.

They

should also control the quality of consumer loans, and improve the efficiency

of the loan approval process to reduce risks.

They

should strictly control lending to stock investors to minimize risks in line

with the SBV’s Circular 19/2017/TT-NHNN amending and supplementing a number

of articles of Circular 36/2014/TT-NHNN which provides safety limits in the

banking sector.

Loans

should be prioritized for production and business activities, especially in

agriculture, export and supporting industries, and small and medium, and

hi-tech enterprises.

Japan firm plans solar power plant in Binh Phuoc

Asia

Infonet Inc., a subsidiary of AIN Group of

Tsuyoshi

Sai, chairman and general director of Asia Infonet Inc., was quoted by the

news site as saying that the company is capable of developing solar power

plants and has invested in multiple projects with a combined capacity of

400MW.

According

to the company, Binh Phuoc holds high potential for solar power development.

The

Japanese firm wants to know administrative procedures to implement the

project, especially those for connecting the plant to the national grid and

for selling electricity to enterprises in the complex.

Loi

threw his support behind the project, saying this will be the first solar

power plant in the complex.

The

Binh Phuoc government pledged to create favorable conditions and help the

company get an investment license and propose the Ministry of Industry and

Trade approve the project.

The

provincial government also asked relevant agencies to help the investor

complete procedures this quarter.

Binh

Phuoc has 2,700 sunlight hours a year, so it is calling for investment in

solar power generation.

Debt-laden Mai Linh’s effort to seek help seen faltering

Faced

with huge debt, Mai Linh Group, which is known for Mai Linh Taxi brand

nationwide, is seeking emergency help but the possibility of it getting such

help is low as it is feared that it might set a bad precedent.

The

company has proposed its debts be frozen and its unpaid tax and insurance

premiums be further extended. A news report on news website Vietnamnet said

if Mai Linh’s proposal is approved, it would do more harm than good.

Vietnam

Social Security was quoted by the news site as saying that it has no

authority to freeze or cut insurance debts. Analysts said Mai Linh’s proposal

might not be approved.

The

company earlier wrote to the National Assembly Committee for Social Affairs,

the Ministry of Finance and Vietnam Social Security cataloging its

difficulties. The economic downturn triggered by the 2007-2008 financial crisis

and high interest rates left the company sitting on a mountain of unpaid

taxes, social/health/unemployment insurance premiums and bank loans.

The

news report quoted Mai Linh chairman Ho Huy as saying that like other

traditional transport service firms, Mai Linh is struggling with an unfair

competition with ride-hailing firms Uber and Grab. With revenue considerably

declining, Mai Linh is on the verge of becoming insolvent.

As

of late last October, Mai Linh’s unpaid tax and insurance amounts amounted to

VND150 billion and its late payment penalties some VND80 billion. The company

proposed it be exempted from loan interest.

The

debts belong to Mai Linh’s subsidiaries which have suspended operations and

have piled up since 2012.

Under

the prevailing regulations, tax payments can be rescheduled in some cases

such as natural disasters, fires and accidents.

Huy

previously told the media that for loan interest and late payment penalties,

the company would need a hundred years to pay them off.

Authorities

and experts said difficulties faced by firms should be handled in accordance

with regulations and that there should be no exception.

Mai

Linh has recently made certain changes in its competition with Uber and Grab,

such as launching a mobile app, and planning mergers of its units to increase

competitiveness.

In

the month, prices of seven out of 11 commodity baskets recorded slight

growth, with the highest rate seen in transport at 1.39 percent which was

attributed to the impact of gasoline price adjustments.

Other

goods with higher prices were other goods and services (0.65 percent);

housing, electricity, fuel and construction materials (0.46 percent);

beverage and tobacco (0.33 percent); medicine and healthcare services (0.16

percent); culture, entertainment, and tourism (0.04 percent); and equipment

and home appliances (0.02 percent).

Meanwhile,

decreases were seen in food and catering services (0.21 percent);

telecommunications (0.08 percent); and garment, hat and footwear (0.01

percent).

In

January, the price of education remained stable.

The

price of gold increased by 0.44 percent, while the price of US dollar

declined 0.02 percent from that of January 2017.

VND1 trillion mall comes into operation

Lead

investor Tran Le Nguyen on January 25 inaugurated the VND1-trillion (US$44

million) Van Hanh Mall, the largest commercial center in District 10, HCMC.

The

eight-story Van Hanh Mall at

The

mall has a wide range of products such as fashion, cosmetics, furniture,

household appliances, and food, which can be found at more than 200 stores of

domestic and international brands like Co.opXtra, CGV, Power Bowl, Nike,

Levi’s, Adidas, and Starbucks.

Tran

Le Nguyen, who is also general director of food processor KIDO Corporation,

said he will inject more money into developing infrastructure for the mall.

In

2008, he put

He

stressed the quality of services and goods, and convenient locations for

customers could guarantee success for shopping centers. “We choose

prestigious partners and good services to meet customer demand whenever they

come to Van Hanh Mall for shopping and entertainment,” he said.

He

added shopping space at Van Hanh costs US$30-60 per square meter and that it

is now over 90% full thanks to the presence of major and reputable brands.

The

Vietnam-France high-level economic dialogue was co-chaired by Vietnamese

Deputy Minister of Planning and Investment Nguyen The Phuong and French

Minister of State attached to the Minister for Europe and Foreign Affairs

Jean-Baptiste Lemoyne in

The

event was held as part of activities to mark the fifth anniversary of the

establishment of the strategic partnership and the 45th anniversary of

diplomatic ties between

In

2017, two-way trade between

At

the meeting, the co-chairs underlined growing food trade between

The

event was attended by Government agencies and businesses from the two

countries and focused on two major topics of the bilateral strategic

partnership, namely climate change and infrastructure development.

The

topics have been reflected through the French Development Agency’s Water

Action Plan and numerous projects and initiatives that would be funded by

French agencies like CLS’s remote sensing service for climate change

responses, EDF’s solutions for a sustainable city and Air Liquide’s

cooperation project for petrochemical development.

Stainless steel traders complain about time-consuming tests

Stainless

steel traders now have to wait at least six months to receive results of

tests on their shipments even though the maximum period under the current

regulations is five working days.

At

a dialogue between the HCMC Customs Department and the American Chamber of

Commerce in

According

to Decision 2999/QD-TCHQ dated September 6, 2017 of the General Department of

Vietnam Customs, customs offices must complete inspections and analyses of

imports and exports in five to eight days, a customs officer told the Daily

on the sidelines of the dialogue.

Nguyen

Quoc Toan, deputy director of the import-export tax division at the HCMC

Customs Department, admitted a large volume of stainless steel samples is

being stored at the customs office as tests are done by only one agency,

leading to a huge backlog.

Tests

are conducted in accordance with a decision on anti-dumping duty on stainless

steel of the Ministry of Industry and Trade. Although the decision is

applicable to steel imports from certain markets, the Ministry of Finance has

asked the customs to inspect all shipments.

Nguyen

Huu Nghiep, deputy head of the HCMC Customs Department, said the Prime

Minister would issue a new decree providing new customs regulations in March.

Particularly, the customs will classify commodities after relevant agencies

provide enough information.

In

addition, the Ministry of Finance has sent the Government a draft decree

which contains measures for removing obstacles to the national one-door

customs mechanism.

Accordingly,

ministries and agencies will implement inspections based on product

classifications by customs agencies, and export and import procedures must be

completed on the national one-door portal.

The

draft decree is expected to be approved this quarter.

Agriculture ministry advises farmers not to expand pepper

planting area

The

Ministry of Agriculture and Rural Development has advised farmers not to

cultivate new pepper plants, transfer into other crops if the plants die of

diseases and gradually reduce pepper area to 100,000 hectares.

At

a conference on sustainable pepper production yesterday, minister Nguyen Xuan

Cuong said that pepper growing area has tripled to 152,000 hectares, output

had also tripled during seven years in 2010-2017.

The

too fast development has showed many problems including out of control area

and quality and others in farming process and density. Purchase, processing

and export organization has not been appropriate to the pepper industry’s

value.

While

pepper demand increases only 3 percent in the world a year, global area hikes

8 percent to 600,000 hectares from 420,000 hectares in 2013. That has caused

price fall to about VND60,000 a kilogram, accounting for half of last year

price. It is forecast to remain low in the upcoming time.

Minister

Cuong said that the pepper industry would lag behind without restructuring.

Vietnam cashew association building material zone in Cambodia

The

import volume exceeded 1.1 million tons in 2016 and neared 1.5 million tons

in 2017 from only tens of thousands of tons in previous years. Businesess

have mainly imported the nut from African nations especially

Vinacas

hoped that cooperation with

According

to Mr. Nguyen Duc Thanh, chairman of Vinacas, besides building domestic

material zones to prevent area reduction and increase productivity, the

association has surveyed some Cambodian places adjacent to Vietnam and realized

that local soil conditions are similar to southeast region, the capital of

Vietnam’s cashew industry, and suitable with cashew growth.

In

fact,

Head

of the Agricultural Department under the ministry Hean Vann Horn said that

For

the last two years, raw cashew export from

Mr.

Hean Vann Horn said that Cambodian side hoped Vinacas to assist them from

sapling selecting, farming process, harvest technique and preservation to

improve productivity and cashew quality to ensure profit for Cambodian

farmers.

According

to the Vietnamese Ministry of Agriculture and Rural Development, the country

exported 350,000 tons of cashew nuts last year with the turnover of $3.5

billion, up 1.9 percent in volume and 23.8 percent in value over 2016.

Cashew

ranks first in the group of major export commodities including vegetable,

coffee, rice and pepper.

The

nut consumption increases about 10 percent a year in the world while area

increase possibility is only five percent. This is a condition for the cashew

industry to develop in the upcoming time.

International

Nut and Dried Fruit Council (INC) said that dried nut transaction value

approximates $30 billion a year in the global market. With this trend, cashew

will account for nearly 29 percent of the world market share by 2021,

followed by walnut.

Vietnamese businesses anticipate interest rate cuts in 2018

Several

local banks have decided to cut their lending rates in early 2018, especially

for loans in priority sectors, which is welcome news for business as it is

anticipated to facilitate them in accessing bank loans.

In

response to the central bank governor’s request to cut costs in order to

lower lending rates, a number of commercial lenders, including Agribank,

Vietcombank, Vietinbank, VPBank and BIDV, have recently trimmed their rates

by 0.5 to 1 percentage point.

Specifically,

Agribank has cut the rate on short-term loans from 6.5% to 6% and medium and

long-term loans from 8% to 7.5%.

Vietinbank

has cut its rates on short and medium-term loans for priority sectors by 0.5

percentage point while Vietcombank has lowered its rates to 6% on loans for

priority sectors.

BIDV

has also chopped its rates on short-term loans by 0.5 percentage point to a

maximum of 6%.

Such

rate cuts are considered by analysts as a significant effort by credit

institutions ahead of the Lunar New Year. But because of the timing, the rate

cuts have been chiefly made by large banks while smaller lenders remain

relatively quiet.

Many

analysts have said that it will be difficult for banks to lower their lending

rates in the future because they are still competing for deposits and a

market share, making it impossible for them to lower the deposit rates and

consequently the lending rates.

As

such, whether the recent rate cuts would become a clear trend and spread

through the entire banking system in the future remains uncertain.

Banking

expert Nguyen Tri Hieu said that commercial banks are trying to bring down

interest rates but it cannot be done immediately because many are struggling

with low liquidity as funds are withdrawn for shopping and paying bonuses

ahead of the Lunar New Year.

In

addition, under a recent circular issued by the central bank, the maximum

proportion of short-term funds allocated to medium and long-term lending has

been reduced from 50% to 45% from 2018 and will fall to 40% from 2019. Such a

tightening measure means a likely rise in the medium and long-term rates in

the future.

Economist

Can Van Luc said that there isn’t much room for rate cuts in the near future

since it is very difficult to reduce the deposit rates, adding that bad debt

has not been resolved radically, although the pace has been accelerated.

The

National Financial Supervisory Commission (NFSC) stated that interest rates

have not been lowered as expected because of a lack of connection between the

deposit market and the interbank market.

Specifically,

interbank rates are relatively low while deposit rates have not been reduced

considerably because good liquidity is seen mainly in large banks.

In

the meantime, a number of small banks or those in the process of

restructuring are still struggling to gain access to low-interest funds on

the interbank market and are forced to maintain or raise their deposit rates.

Furthermore,

bad debt remains a significant hurdle to rate cuts while the net interest

margin of local banks is rather modest compared with their regional peers,

which also discourages them from reducing lending rates, the NFSC said.

Therefore,

many experts have called for stronger action from both the government and the

banking system in order to bring down interest rates. The government needs to

maintain inflation at 4% and take bolder measures to tackle non-performing

loans in a more effective manner. At the same time, it is also an opportunity

to reduce lending rates if bank credit-related public investment is well

managed.

Revised policies required to develop private sector

Despite

the implementation of a number of policies in support of the private sector

over the past few years, the private sector remains insignificant.

According

to Nguyen Duc Thanh, Director of the Vietnam Institute for Economic and

Policy Research under the

Professor

Tran Van Tho from

SOEs

hold high positions and are provided with preferential treatment in terms of

capital and land while these factors of production are disadvantages to small

private enterprises, requiring institutional reform in the factors of

production to enhance resource efficiency and productivity.

Although

the foreign direct investment (FDI) sector occupies a large proportion of the

economy, it creates a negligible impact on economic structure transfer. In

addition, the link between FDI and domestic enterprises remains weak,

creating limited influence on technology and knowledge transfers. A strategy

for increasing the connectivity between the FDI and domestic sectors would

help to improve the productivity of domestic enterprises.

Thanh

said that raising the private sector is crucial for national development, but

it is difficult to make the private sector grow in a robust fashion. The

biggest obstacle to the economy is the dominant role of the State in all

areas, including State management and SOEs. Thus, it is necessary to devise a

transparent law system which is committed to protecting the ownership rights

and achievements of businesses through streamlined procedures when solving

any disputes.

When

the people and enterprises continue making complaints about policies, it

means that the management apparatus has yet to pay off. Professor Tho said

that it is necessary to encourage start-ups in addition to devising policies

to nurture enterprises and help them to increase their size.

He

noted that light industries also need to increase their size in order to

renew their technology, enhance productivity and improve competitiveness.

Furthermore,

Sharing

the same view as Tho, Dr. Vu Thanh Tu Anh from

Enterprises

operating in

It

would appear that

Economist

Pham Chi Lan stated that

The

expert recommended policy adjustments in order to encourage enterprises to

take part in industries.

In

addition, Deputy Minister of Finance Do Hoang Anh Tuan stated that there have

been a lot of inadequacies with regards to tax incentives over the past 20

years. For instance, the taxation statistics released by the Finance Ministry

showed that the FDI sector received over VND35 trillion (US$1.54 billion) worth

of tax exemption out of VND37 trillion (US$1.63 billion) tax payments, which

was a result of the price escalation in tax incentives charges.

The

reality also poses a risk to transfer pricing and incentives following tax

periods, requiring the promulgation of a simple tax law system and accounting

policy. Meanwhile, it is advisable to revise tax policies on the basis of

expanding the tax base but not increasing the tax and tax payment rates.

CBRE to manage Van Tri Avenue Villas

CBRE

Vietnam has been officially appointed by Noble Vietnam as property management

agents for its Van Tri Avenue Villas, starting from January 24.

Villas

come in four or five bedrooms on areas of 1,100 to 1,300 sq m and are

expected to be handed over in December 2019.

CBRE

will sell seven type A villas and five type B villas. Type A villas cover

area of 1,150 sq m and overlook the lake and nearby Van Tri Golf Club, with a

housing area of 384 sq m and 814 sq m of total floor area on three floors.

Each boasts a swimming pool and are priced from $2,100 to $2,300 per sq m.

This

is the only golf villa project located in the ASEAN City @ Hanoi complex,

which is being planned and developed along the 11-km road from Noi Bai

International Airport to Nhat Tan Bridge and covers an area of 1,900 ha,

including Van Tri Golf Club, Concordia Hanoi International School, and the

Van Tri Urban Area, which will have 1,214 high-end apartments.

Outstanding

facilities such as the golf course are managed under international ISO:14001

standards with practice holes and greens, while the complex also has an

international school, a luxury restaurant, a spa, a wedding center, a clinic,

and a supermarket and retail stores.

FE CREDIT signs $50mn loan facility with Lion

The

VPBank Finance Company (FE CREDIT) recently announced it has received a $50

million loan facility from Lion Asia I (RB) Limited as additional capital to

continue to grow its business as the market leader in

Lion

Asia, an entity established in the British Virgin Islands and 100 per cent

owned by the Lending Ark Asia Secured Private Debt Fund, acted as facility

agent for the $50 million loan. The Fund was established by Lending Ark Asia

Secured Private Debt Holdings Limited, a market leader in complex, innovative

secured private credit lending across the Asia-Pacific region.

As

one of only a few pioneers in

“This

cooperation continues to re-affirm our brand value and the operational

excellence of our business in meeting the highest level of international

standards,” said Mr. Kalidas Ghose, Vice Chairman and CEO of FE CREDIT. “This

loan facilitates the growth of our business in the future by providing

solutions to the needs of millions of people across

“It

is a great honor to announce the successful completion of our $50 million

loan facility for FE CREDIT,” said Mr. Gregory Park, Managing Director - Fund

Head and representative of Lion Asia. “With tremendous support from the State

Bank of

FE

CREDIT also acquired a $100-million senior secured loan from Deutsche Bank

two months ago for its expansion plans.

US's Sanford Health shakes hands with Victoria Healthcare

The

Its

international healthcare arm, Sanford World Clinic (SWC), is cooperating with

Victoria Healthcare (VHC) in

This

is the first agreement in Southeast Asia for SWC and represents the beginning

of cooperation and professional support to VHC from one of the leading

healthcare systems in the

“We

believe in the quality of services, procedures, systems, and business

strategies of VHC in

After

more than 12 years of operations, VHC has opened four branches in

It

signing a comprehensive strategic cooperation agreement with SWC is a new

step forward for

Sanford

Healthcare is a leading healthcare organization in the

Sanford

Health will also enter

“With

these partnerships, we are creating unique opportunities for shared

learning,” said Mr. Kelby Krabbenhoft, President and CEO of Sanford Health.

“This is not something we are pursuing for financial gain, as we believe this

type of collaboration will help further our mission of health and healing.”

$185mn raised from PV Oil IPO

The

government raised VND4.18 trillion ($185 million) from selling 20 per cent of

the country’s sole crude oil exporter, the PetroVietnam Oil Corp. (PV Oil),

at an initial public offering (IPO), the company announced on January 25.

The

proceeds exceeded the government’s target of $122 million from the sale,

which is part of plans to equitize hundreds of State-owned enterprises (SOEs)

to boost their performance, ease a tight State budget situation, and reform

an economy that is highly reliant on foreign investment.

Demand

at the January 25 IPO of PV Oil, Vietnam’s second-largest oil products

retailer with a 22 per cent market share in the domestic oil products market,

was 2.3-times higher than availability, the company said.

A

total of 3,195 investors took part, including 54 foreign institutional

investors. Overseas investors purchased 6.6 per cent.

Post-IPO,

PetroVietnam Board Member Mr. Dinh Van Son said PV Oil would file for a

listing on the Unlisted Public Company Market (UPCoM) within the next three

months and would work to complete the company’s strategic stake sale.

A

further 44.72 per cent stake will be sold to strategic investors, both

domestic and foreign. The government’s ownership is to be reduced to 35.1 per

cent after the equitization process is completed.

Eight

investors, including a founding shareholder in

The

six foreign bidders are Shell, Idemitsu, Puma, Kuwait Petroleum International

(KPI), PTT, and SK, while the two Vietnamese contenders are the Sacom

Investment Fund and Sovico Holding, he said.

“We

have received an application from a foreign investor who expressed a wish to

buy 49 per cent of PV Oil shares, the cap set for foreign investors,” he

added.

As

other foreign investors want to buy between 25 and 35 per cent, the total

shares investors have registered to buy exceeds the number to be sold.

Foreign

ownership of PV Oil is capped at 49 per cent of charter capital, while

foreign investors are also required to deposit an amount equivalent to 20 per

cent of the stake they have registered for prior to entering the auction.

Investors

seeking to become strategic investors must commit to long-term investment by

retaining their holding for at least ten years. They must also commit to

prioritizing buying petroleum products from the Dung Quat Oil Refinery and

the Nghi Son Refinery and realize commitments in terms of market, technology,

and management development.

Mid-year IPO for Vinalines

The

government has asked for the company to be equitized but plans to retain a 65

per cent stake, he said, with the remainder being sold to local and foreign

investors.

According

to a plan submitted by the Ministry of Transport to the government for

approval, Vinalines’ charter capital stands at nearly VND13.92 trillion ($630

million).

Mr.

Tinh said 2017 revenue was estimated at VND16 trillion ($702.4 million),

exceeding the annual target by 15 per cent. More than VND4.4 trillion

($193.16 million) came from port services while VND7.1 trillion ($311.7

million) was made from transport services.

Profit

was VND515 billion ($22.6 million) and total assets stood at over VND18

trillion ($790 million). It targets consolidated profit of $75.8 million on

revenue of $757.7 million by 2020.

The

company held a regional maritime exhibition in

Vinalines

has worked with the Auditing Company Limited & Vietnam Appraisal and the

ATC Auditing and Valuation Firm Company to complete its valuation, which

under current regulations must then be appraised by State Audit of Vietnam.

The

shipping company once symbolized the post-war promise of

The

government has taken cautious measures to hasten the overall equitization

process, including forcing public companies to list shares on the local stock

exchange.

Vinalines’

IPO was first due to be held in the first quarter of 2015. It proposed

removing five ships - Vinalines Global,

MEF II divests from MobileWorld

Mekong

Capital has announced that its Mekong Enterprise Fund II (MEF II) has

completed its full divestment from the MobileWorld Investment Joint Stock

Company (MobileWorld), the largest mobile device and home appliance retailer

in

This

was the culmination of an exit process that began with a pre-listing private

placement shortly before the 2014 public listing of MobileWorld on the Ho Chi

Minh Stock Exchange and involved gradually selling blocks of shares to

institutional investors approximately once a quarter after the listing. The

final block of 5 million shares were sold at a price of VND165,000 ($7.39)

per share and was completed on January 29.

“MEF

II was launched in 2006 and ultimately had a 12-year term, hence we needed to

complete the divestment of our remaining investments, including MobileWorld,

in the first few months of 2018,” said Mr. Chris Freund, Partner at Mekong

Capital. “If it wasn’t for MEF II’s limited timeframe, we would have wanted

to continue as a shareholder of MobileWorld for the foreseeable future,

especially as they ramp up Bach hoa xanh into

MEF

II originally invested $3.5 million in MobileWorld for a 35 per cent stake in

2007. The cumulative net proceeds from the sale of MobileWorld shares and

dividends received was $199.4 million. When MEF II originally invested in

MobileWorld in 2007, they had seven stores and a $10 million valuation. “Our

original goal was to increase to 50 stores and a $50 million valuation,” said

Mr. Freund. “The success of this investment has exceeded our wildest expectations.”

Many

factors contributed to the success, he added, but at the core was

MobileWorld’s five co-founders and their open-mindedness, proactiveness,

willingness to improve, and complementary points of view. “Together they had

a big vision, built an extraordinarily strong team and a strong corporate

culture, put the interests of customers first, and created an unstoppable

machine that consistently sets the standard for retailing best practices in

He

added there is currently no company in

Mekong

Capital’s investment framework, called Vision Driven Investing, has

consistently enabled its funds to realize high rates of return. The framework

enables investee companies to create a big breakthrough vision and achieve

their vision while creating significant value creation for shareholders.

MobileWorld was both an inspiration for, and model of, the Vision Driven

Investing framework.

During

MEF II’s ten and a half year holding, MobileWorld has grown from seven stores

to over 2,000 today under four different retail brands: thegioididong.com,

Dien may xanh, Bach hoa xanh, and vuivui.com. The company has also recently

announced the acquisition of Tran Anh Digital World and the Phuc An Khang

pharmacy chain.

Launched

in 2006, MEF II is the second private equity fund managed by Mekong Capital.

It made ten investments, of which nine have already been fully exited. The

Fund’s only remaining investee company is Asia Chemical Corporation (ACC).

Its other notable investments included Golden Gate,

As

at December 31 it operates 1,070 thegioididong.com outlets in all 63 cities

and provinces nationwide, making it the Number 1 mobile retailer in

VNN

|

Đăng ký:

Bài đăng (Atom)