|

Finance ministry says no

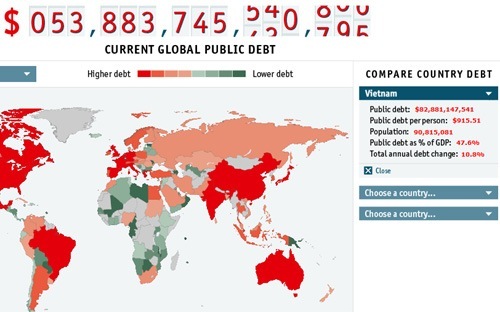

need to worry about public debt, economists disagree

The Ministry of Finance (MOT) says that

the public debt is not as alarming as economists repeatedly claim.

One of the biggest problems, according to the

economists, is that the country now has to get new loans to pay old debts.

However, loans should be used to expand production, and

money for debt payments should come from profits from business production

expansion.

Nguyen Sinh Hung, chair of the National Assembly, has

said that it is unsafe to borrow money to pay debts, and that the National

Assembly would agree on a government proposal to lift the ceiling for

expenditures in order to stimulate investments, but not to pay debts.

However, MOF has said that it is not a big problem at

all to get new loans to pay old debts, if the total debt and the debt peaks

at certain moments do not exceed the safety threshold set by the National

Assembly and the government.

The ministry said that although the total public debt

had increased recently, the ratio of public debt of the Gross Domestic

Product (GDP) remained unchanged. The ratios were 51.7 percent in 2010, 50.1

percent in 2011, 50.8 percent in 2012 and 54.1 percent in 2013.

Regarding the debt payment duty, Truong Hung Long,

director of the MOF’s Debt Management and External Finance Department, said

in principle the debt payment must not be higher than 25 percent of the

state’s revenue.

Meanwhile, the state’s debt payment in 2013 only

accounted for 12.6 percent of the budget’s revenue.

A question has been raised about

Does

On this issue, Long said that in principle, it would be

better to seek both short-term and long-term capital to optimize efficient use

of capital.

“In the past,

“The important story here is that the government needs

to have good management skills to borrow money at the lowest possible costs,”

he said.

Nevertheless, despite the MOF’s explanation, economists

continue to worry about the public debt situation.

Vu Dinh Anh, a renowned economist, pointed out that the

debt duties have been increasing, while MOF says nothing about where the

money to pay for the debts would come from.

In principle, the government needs to apply necessary

measures to gradually reduce the loans to offset the budget deficit. In other

words, it needs to find sources of revenue in the future to make up the

budget deficit now.

“However, no state management agency has figured out a

plan to reduce the budget deficit. This is really worrying,” Anh said.

TBKTVN

|

Chủ Nhật, 17 tháng 8, 2014

Đăng ký:

Đăng Nhận xét (Atom)

Không có nhận xét nào:

Đăng nhận xét