|

BUSINESS NEWS

IN BRIEF 1/9

Vinatex completes 65% of yearly

revenue target

Viet

Nam National Textile and Garment Group (Vinatex) has completed 65 per cent of

the yearly target set for total revenues with its eight-month result

(excluding VAT) reaching over VND31.45 trillion (US$1.34 billion).

This

figure also represented a rise of 7 per cent against the same period last

year, the textile group reported in a filing to the Ministry of Planning and

Investment.

In

August alone, it earned VND4.48 trillion in revenue, down 5 per cent

year-on-year, of which turnover of the parent company and subsidiaries with

its holdings of over 50 per cent capital reached almost VND1.74 trillion.

Revenues from other affiliate companies in which the group holds less than 50

per cent capital reached a combined VND2.74 trillion.

Vinatex

attributed the growth in total revenues to increases in sales of fibre

products (96,051 tonnes, up 9.5 per cent year-on-year), fabric of all kinds

(100.7 million m3, up 18.6 per cent) and garments (168 million products, up

2.2 per cent).

In

terms of import-export activity, it increased imports while exports declined.

Vinatex

exported goods worth nearly $246 million in August, down 4.5 per cent

year-on-year. Meanwhile, its export value rose by 4 per cent to $105.5

million.

After

eight months, export value is estimated at $1.81 billion, growing 6 per cent

year-on-year, while the import value also increased 4 per cent to $838.8

million.

Cao

Huy Hieu, Vinatex CEO, predicted exports of textile and garment products of

Viet Nam will hit $35 billion by year-end, $1 billion higher than the target

of $34 billion set for the whole year.

Many

garment companies have received buy orders to the end of the year, including

Vinatex, Viet Tien Garment Corporation, Regent Garment Factory Co Ltd, Regina

Miracle International Vietnam Co Ltd and Worldon (Vietnam) Co Ltd, Hieu said.

Vinatex

is trading shares on the Unlisted Public Company Market (UPCoM) at around

VND10,000 per share.

Chemical firm cancels listing

Duc

Giang-Lao Cai Chemicals JSC will cancel its listing on the Ha Noi Stock

Exchange (HNX) on September 5, according to the northern market regulator.

The

company will remove its nearly 100 million shares, listed as DGL on the HNX,

after its last trading date on September 4.

The

HNX said in its statement that the cancellation came after Duc Giang Chemical

and Detergent Powder JSC (HNX: DGC) on August 8 announced it would issue

nearly 58 million shares at a share swap ratio of 1:1 to convert DGL shares.

DGL

shares will be converted into DGC shares. The list of beneficial shareholders

was finalised on August 22.

The

share swap deal was approved by the two firm’s shareholders and market

regulators in mid 2017.

The

post-merger company will also cancel its listing on HNX to move to the HCM

Stock Exchange.

DGL

shares rose 0.4 per cent to close Wednesday at VND40,000 (US$1.78) per

share.

Viet Dragon Securities joins derivatives market

Viet

Dragon Securities Corporation (VDSC) on Tuesday became the newest trading

member of the derivatives market.

Viet

Nam’s derivatives market has been operating for more than one year but it has

made some great achievements with rising trading liquidity, which proves the

market has quite high development potential.

According

to VDSC general director Nguyen Hieu, the company has done a lot of work to

meet requirements on financial status, risk management, and consultancy and

management personnel.

The

company has also upgraded its IT infrastructure and improved its partners’

derivatives trading systems.

The

company would also provide investors with internet-connected devices and

applications to make their trading activities more convenient and less risky,

he said.

The

participation of VDSC in the derivatives market has raised the total number

of trading members to 10.

Other

derivatives trading members included BIDV Securities Corp (BSC), Saigon

Securities Inc (SSI), MB Securities JSC (MBS) and HCM City Securities Corp

(HSC).

VDSC

is listing more than 100 million shares on the HCM Stock Exchange with ticket

VDS. Its shares have rallied total 26.6 per cent since August 16 to close

Wednesday at VND10,000 (US$0.44) per share.

In

the first six months, VDSC earned VND54.3 billion ($2.4 million) worth of

post-tax profit, down 5 per cent year on year. The company has fulfilled 38

per cent of its full-year profit target.

RDP to issue 5.66m bonus shares

Rang

Dong Plastic JSC plans to issue nearly 5.66 million bonus shares due to its

2017 performance at the ratio of 20 per cent.

This

means each shareholder will receive 20 new shares for every 100 shares they

own, with the share issuance worth nearly VND56.6 billion (US$2.5 million).

The

company is listing more than 28 million shares on the HCM Stock Exchange

under code RDP. Its shares soared 6.7 per cent to close Wednesday at VND14,300

($0.63) per share.

The

company recorded VND1.32 trillion of net income in 2017, a yearly increase of

12 per cent.

RDP

reported losses of VND55 billion from its business activities last year due

to sharp increases in sales and corporate governance costs.

However,

the company’s financial statement reported its undistributed post-tax profit

for 2017 reached VND69 billion as RDP sold a part of its ownership in a

subsidiary.

Binh Phuoc hands over land for Thaigroup cement plant

The

People’s Committee of Binh Phuoc Province has issued Decision No.

1875/QD-UBND to hand over to Thaigroup JSC for the construction of the Minh

Tam Cement Plant.

Accordingly,

the provincial People’s Committee decided to reclaim 42,431.9sq.m of land

managed by the People’s Committee of Hon Quan District, for Thaigroup to

begin construction. The total area of 430,612.4sq.m, including 42,431.9sq.m

above and 388,180.5sq.m of other land, is from households which have been

compensated for the construction site of the Minh Tam plant.

Under

the decision, agencies and units, including the Department of Natural

Resources and Environment, shall direct the Land Registration Office to

compile dossiers for the determination of cadastral information on land plots

and send it to competent authorities to determine Thaigroup’s financial

obligations and adjust the cadastral file in accordance with the regulations.

In

early 2017, Thaigroup started the construction of Minh Tam Plant after

purchasing the Minh Tam Cement project from its former owner, Mien Dong Joint

Stock Company, which was facing financial difficulties.

The

Minh Tam cement plant uses advanced European methods, ensuring environmental

standards are maintained. The project covers an area of 400ha with

total investment capital of VND12 trillion (US$515 million) and a total

capacity of 4.5 million tonnes of cement per year. Construction is estimated

to take two years, of which, the first phase will produce 2.6 million tonnes

of cement per year with investment of nearly VND6.8 trillion.

Yuan payment allowed in VN, China border areas

Chinese

yuan will be allowed for payment in the border areas between Viet Nam and

China.

The

announcement was part of Circular No 19/2018/TT-NHNN, which will take effect

from October 12 this year.

Besides

the yuan, traders and residents in the border areas of Viet Nam and China,

can also use Vietnamese dong or fully convertible currencies, such as the US

dollar, Euro or Yen, for payment of goods and services.

In

addition to individuals, some other organisations will be subject to the new

regulation. They include commercial banks and branches of foreign banks

licensed to conduct foreign exchange transactions in Viet Nam; branches of

banks located in border areas and border-gate economic zones of Viet Nam and

China; organisations trading in duty-free goods; organisations providing

services in isolated areas at international border gates; organisations

engaged in bonded warehouses in border regions; the Viet Nam-China Border

Gate Economic Zone; and other organisations and individuals conducting

payment activities in Viet Nam-China border trade.

Payment

can be made through banks or in cash in dong or yuan, according to the

circular.

Economic

and trade co-operation between China and Viet Nam has become increasingly

close in recent years, and there is huge demand and an increasing trend

toward yuan settlement in Viet Nam.

Viet

Nam has overtaken Malaysia to become the largest trade partner of China in

the Association of Southeast Asian Nations (ASEAN). Total trade revenues

between Viet Nam and China were estimated at US$66 billion in the first half

of 2018, with the average monthly trade turnover between the two countries

having exceeded $10 billion for the first time in history.

Large firms boost transparency

Some

large-cap firms have replaced the board of supervision with independent

members in the board of management to improve the quality of corporate

governance and reduce expenses.

Additionally,

such actions may improve a company’s transparency to investors and

shareholders so it is able to draw more capital from both domestic and

foreign investors.

The

firms include Viet Nam Dairy Products JSC (Vinamilk), Refrigeration

Electrical Engineering Corporation (REE), Coteccons Construction JSC (CTD)

and property developer Novaland (NVL).

However,

many other listed companies have not followed suit.

Starting

from 2015, a listed company can replace the old-fashion board of supervision

with an independent audit agent that is appointed among other members of the

management board.

Most

enterprises do not have a board of supervision in their structure, however

Viet Nam is among few countries where a majority of businesses do.

According

to Pham Ngoc Hoang Thanh, CEO of financial-accounting training service

provider Smart Train, the formation of a supervision board may come from the

old business model of the Soviet Union.

Though

professional licences were required for all members of the supervision board,

it had remained unclear so far, Thanh said, adding that was the reason why

the supervision board in each company had not made a great impact on business

performance.

Therefore,

the removal or replacement of the supervision board may help reduce expenses

for the company and improve the role of the management board, Thanh said.

According

to the world’s top-four audit and consulting firm PricewaterhouseCoopers

(PwC), internal audit may help a business save 5 per cent of revenue losses.

That

ratio may be higher for a Vietnamese business if it was courageous enough to

get rid of the supervision board, Thanh said.

Hiring

an audit company from the outside may only help review the financial reports

to find financial violations, so it was necessary for a firm to establish its

own internal audit unit, he added.

Independent

members of the management board, or internal auditors, would protect the

rights and benefits of shareholders and help business leaders develop their

strategies, Thanh said.

However,

the legal framework had remained unclear regarding the function, appointment

and responsibility of the internal auditors so local companies were hesitant

to remove their supervision boards, according to Thanh.

The

quality of the employees was another issue as internal auditors should have

worked at the company for a long time, thus having a strong voice among

company members, Thanh said.

But

such employees were also required to quickly adapt to the economic and

financial changes, and be responsive to Industry 4.0, he said, adding that

Viet Nam still lacked high-quality young employees to resolve the

problem.

Doosan starts work on power plant

Doosan

Heavy Industries & Construction (DHIC) and Doosan Heavy Industries Viet

Nam (Doosan Vina) – two subsidiaries of South Korea’s Doosan Group, began

construction of the Nghi Son 2 Thermal Power Plant project in Thanh Hoa

Province on Monday.

A

source from Doosan Vina said the two firms will build two supercritical

boilers, high efficiency turbines and generating units for the 1,330 megawatt

(MW) Nghi Son 2 Power Plant, slated for completion in 2022.

The

thermal power plant, invested in by a joint-venture of Marubeni of Japan and

Korea Electric Power Corporation (KEPCO) with total investment US$2.79

billion, will supply power for 6.8 million households.

Earlier,

Doosan received an advance payment of $170 million from Marubeni and KEPCO to

commence construction of the two turbines and boilers.

Since

2012, DHIC has won more than $6 billion in orders in Viet Nam that include

the contracts for the Mong Duong 2, Song Hau 1 and Vinh Tan 4 power plants.

The

Doosan Group is a global multinational focusing on power, water and

infrastructure developments worldwide. The company is headquartered in Seoul,

South Korea, and has operations in 38 countries and $22 billion in annual

revenue.

Doosan

Vina, based in Quang Ngai Province, provided rail mounted quay cranes and a

high-tech pressure equipment for the Nghi Son Refinery & Petrochemical

project in 2014-15.

It

exported made-in-Viet Nam boilers, heat recovery steam generators and

desalination, crane and chemical processing equipment valued at US$2.4

billion in 2017.

Coastal province eyes ways to boost tourism, protect

environment

The

southern province of Ba Ria – Vung Tau held a workshop on August 29 to seek

ways to develop tourism in tandem with environmental protection as part of the

sea festival now underway in the province.

At

the event, participants delivered presentations on how tourism impacts the

marine environment and proposed solutions to develop plastic-free tourism,

apply new technology in marine environment management and enhance Vietnam’s

marine environmental protection to foster sustainable sea-based tourism.

The

Ba Ria – Vung Tau Department of Culture, Sports and Tourism and the local

Tourism Association briefed attendees on the strengths of the province’s

marine tourism and steps it has taken to build its tourism brand.

Ba

Ria – Vung Tau has worked to make the province a regional hub for tourism and

entertainment, said Pham Ngoc Hai, President of the Ba Ria – Vung Tau Tourism

Association. It has heavily invested to develop five key tourism clusters,

including Vung Tau City, Long Hai – Phuoc Hai, Dinh Mountain, Binh Chau – Ho

Coc and Con Dao Island, he noted

Director

of the Ho Chi Minh City Institute for Development Studies Tran Anh Tuan

suggested that the province should sustainably develop the tourism industry

by promoting cultural values, tourist attractions and historic relics, and

protecting the environment.

The

province must also diversify tourism products and strengthen supply chain and

services, while local schools and enterprises need to provide tourism workers

with necessary skills, particularly in foreign languages, information

technology and international regulations.

The

Ba Ria-Vung Tau Sea Festival opened in the southern province on August 28 as

part of activities marking the country’s 73rd National Day (September 2).

Themed

“Ba Ria-Vung Tau, Aspiration, Love and Sea”, the festival aims to bolster

investment, trade, tourism and economic development of the province and

connect it with other coastal localities.

The

festival has attracted more than 400 businesses and cultural organisations

from 26 provinces and cities to participate in economic, cultural and sports

activities during the seven-day event.

It

includes a trade fair, a kite performance, a beer festival and a series of

seminars and workshops on trade and tourism promotion as well as

environmental protection.

An

outdoor electronic dance music concert titled “Sea Run” will also take place,

featuring pop star Son Tung M-TP alongside a parade of classic Vespa

scooters. Exhibitions will be organised to showcase calligraphy works, orchid

flowers and sand statues.

Some

500,000 visitors are expected to flock to the festival, which ends on

September 3.

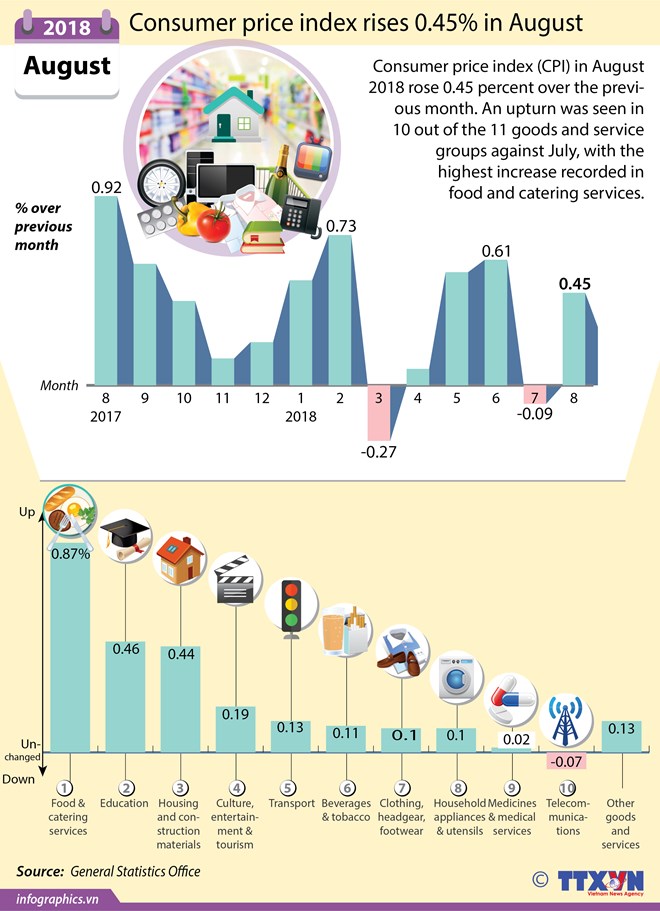

HCM City’s CPI up 0.48 percent in August

The

consumer price index (CPI) of Ho Chi Minh City in August increased 0.48

percent against the previous month and 3.51 percent compared with the same

period last year, the municipal Statistics Office reported on August

30.

Eight

of 11 groups of commodities saw their prices go up in the month, with the

highest rise recorded in food and catering services at 0.84 percent

month-on-month.

Other

groups with hikes were housing, electricity, water, fuel and construction

materials, up 0.75 percent; goods and other services, 0.46 percent;

transport, 0.27 percent; household utensils, 0.21 percent; culture,

entertainment and tourism, 0.13 percent; and education, 0.1 percent.

Some

groups experienced a drop in their prices such as clothing, hats and

footwear, down 0.77 percent; post and telecommunications, 0.05 percent; and

medicine and health services, 0.12 percent. Beverages and tobacco remained

stable.

In

August, the gold price declined 0.19 percent while that of the US dollar went

up 1.18 percent against last month.

The

country’s CPI in the month inched up 0.45 percent month-on-month, and 3.89

percent from the same time last year, pushing up the eight-month figure to

3.52 percent year on year, according to the General Statistics Office (GSO).

The

GSO forecasts a rise in September’s CPI due to price surge in education

service, pork price, gas and gasoline.

HCM City to hold second annual trade event in Laos

Ho

Chi Minh City’s Investment and Trade Promotion Centre will organise the

second HCM City Trade-Service-Tourism Promotion Conference in Savannakhet,

Laos, in October to help Vietnamese businesses tap the Lao market and enhance

co-operation between the two countries, a workshop heard on August 28.

According

to Pham Thiet Hoa, director of the centre, several promotions to encourage

collaboration between Vietnamese and Laos enterprises had been launched in

HCM City and Laos in recent years.

They

included the Laos Goods Week held in HCM City last January and the 2018

Vietnam-Laos Trade Fair in the Lao capital Vientiane in July.

Last

year, the centre held the first conference showcasing HCM City-made products

in Savannakhet, Laos, which attracted more than 100 Vietnamese and 25 Lao

enterprises who signed 50 contracts and four Memorandum of Understandings.

This

year it will organise a similar event from October 19 to 26 at the same

location.

Hoa

said participating enterprises would be fully subsidised for booths, decor,

freight and import tax payable for the event.

According

to the General Department of Vietnam Customs, trade between Vietnam and Laos

was worth 522.2 million USD in the first half of 2018, a 14.5 percent

increase year-on-year.

Vietnam

mainly exports steel and iron products, cement, plastic products, electrical

cables, and fruit and vegetables. It buys fertilisers, wood and wooden

products, ores and minerals from Laos.

Figures

from the Ministry of Planning and Investment’s Foreign Investment Agency show

that Laos is the biggest of Vietnam’s 24 foreign investment destinations.

In

the first five months of this year Vietnam’s investment in Laos was worth

80.12 million USD, or 43.4 percent of its total foreign investment.

Somxay

Sanamoune, Lao Consul General in HCM City, said the Lao government always

encouraged and gave priority to Vietnamese investment.

“The

two countries are very close in terms of geography, which is a great

advantage to boosting cross-border trade, export-import activities and

exchange of workers.”

He

said Laos had great potential waiting to be tapped by Vietnamese businesses

including industrial crops, mining, mineral processing and agri-forestry

products, among others.

He

said to attract foreign investment, the Lao government had reduced red tape

and the time required to set up new businesses, cut tariffs and invested in

infrastructure.

A

survey conducted by the centre at last year’s trade event found there was a

big market in Laos for Vietnamese products, especially mid-priced goods.

Products

that were popular at the event were electrical and mechanical domestic

appliances, food, snacks and processed foods, and textile and apparel.

Le

Tan Minh, deputy head of the centre’s trade promotion department, said

Vietnamese businesses should pay attention to packaging to attract Lao

consumers.

Businesses

should also consider earmarking some space for consumers, especially young

people, to take photos since they were fond of sharing them on social media,

and this would help publicise the event, he added.

According

to Nguyen Quoc Dung, CEO of the Sai Gon Plant Protection Joint Stock Company

which has been selling its products in Laos, Vietnamese enterprises who

wanted to tap the Lao market should first ensure they had a licence and their

products were registered.

“You

have to show your business registration certificate or at least have a big

agent in Laos who can represent you in order to meet with a business there.”

He

said for products like crop protection chemicals and fertilisers, enterprises

should make samples and hold workshops to convince consumers of the quality

of their products.

Besides,

it was very important to have product information and instructions on the

packaging in Lao, he added.

732 domestic firms get FSC Chain of Custody Certification

As

many as 732 domestic businesses have obtained the Forest Stewardship Council

Chain of Custody (FSC/CoC) Certification, taking the lead in Southeast Asia.

Of

the number, 49 firms gained the certification of sustainable forest

management with a total area of 226,500ha, according to the Vietnam

Administration of Forestry (VNFOREST) under the Ministry of Agriculture and

Rural Development.

The

cooperation between wooden processing firms and forest growers has helped to

ensure materials and output, thus stabilising prices of wooden products.

Amid

the increasing demand for wood with legal and clear origins, exporters have

worked to complete production management system and enhance cooperation with

farmers to access to materials meeting international standards, said

VNFOREST.

The

export value of forestry products is projected to hit 5.85 billion USD

between January and August this year, increasing 13 percent on year and

accounting for 23 percent of Vietnam’s total agro-forestry-fishery export.

According

to estimations of VNFOREST, during the eight-month period, the trade surplus

of forestry products will amount to 4.39 billion USD, of which 4.09 billion

USD are contributed by the shipment of timber and wood products.

VNFOREST

forecast forestry export to rise in the remaining months of the year,

particularly to traditional markets like the US, China, the Republic of

Korea, Japan, and the EU.

Incentives needed for agriculture sector

Though

the Vietnamese government and Ho Chi Minh City’s administration offer many

incentives and have favourable policies to encourage businesses to invest in

agriculture, they often remain on paper, heard a conference held in the city

on August 27.

For

instance, a government decree issued last April reduces land rents for

agricultural companies and provides subsidies for research, buying machinery,

human resource training, and construction. However, many firms, and

authorities, are waiting for a circular that will guide implementation of the

decree.

There

are also government policies for agriculture insurance against natural

disasters and diseases in the case of certain crops and animals, credit,

vocational training in rural areas, and financial aid for building fishing

ports, ships and fish farms.

HCM

City has its own policies to encourage businesses to invest in agriculture,

including subsidies for acquiring office facilities and adopting VietGAP

standards.

One

such was Decree 655 issued last February, which was hailed by businesses for

meeting their needs, having simple procedures and waiving interest on loans

for buying machinery, seeds, breeding animals and animal feed and paying

salaries.

However,

the benefits often do not percolate down to businesses. Owner of a cantaloupe

farm in Hoc Mon district Le Nguyen Cam Tu said he has been applying to lease

some public land for a year but has not received any response from

authorities despite the plentiful availability of land.

Renting

private land could be risky since it depends on the whim of the lessor, he

said, calling on authorities to make it easier to lease public lands.

Le

Ha Mong Ngoc, Director of Nam Viet Biotechnology Joint Stock Company, said

she has been unable to get a food safety certificate for her lingzhi

mushrooms despite applying for years.

“Though

our food processing procedures are strict, without proper certification we

cannot sell the mushrooms despite the high demand for the product. Many

farmers we are working with have had to stop growing the lingzhi mushrooms.”

She

also called for better market and product origin surveillance to keep out

fraudulent and low-quality products and protect high-quality brands and

consumers.

The

HCM City’s Department of Agriculture and Rural Development, which organised

the conference, said it would pass on the complaints to relevant departments

for action.

Vinh Phuc presents investment licence to Japanese firms

Authorities

of the northern province of Vinh Phuc have granted an investment licence to

investors of Kowa Global project in Binh Xuyen district’s Binh Xuyen

Industrial Park (IP).

The

project, totaling over 136 billion VND (nearly 5.86 million USD), is invested

by Japanese firms - Kowa Kasei JSC and Kowa Rubber Industries JSC.

This

project will specialise in processing and conducting technical analysis and

verification of rubber products, with a capacity of nearly 140 tonnes of

products per year. It will also provide related consulting and trading

services.

It

is scheduled to be completed and officially put into operation in the second

quarter of 2019, contributing 10 billion VND (430,700 USD) per year to the

State budget.

Kowa

Global is the 23rd secondary project wholly invested by Japan in IPs in Vinh

Phuc. The project is in line with the locality’s policy of encouraging

the development of support industry.

It

will create new products with high competitiveness in the market,

contributing to promoting the province’s socio-economic development.

At

present, IPs in Vinh Yen city and Phuc Yen town of Vinh Phuc have been fully

filled. Investment projects in the province in the near future will be mainly

allocated in IPs of Binh Xuyen district.

Industrial

parks in the district have so far attracted 35,000 labourers, mainly young

workers. Their average per capita income is between 6 million VND (258

USD) and 8 million VND (345 USD) per month.

Experts

said that Binh Xuyen will become really bustling in the time ahead as

businesses are flocking to the district to land their investments.

Thai Nguyen looks for IC infrastructure investors

To

keep up with the burgeoning investor demand, the north-eastern province of

Thai Nguyen is asking investors to build local industrial clusters through

the public-private partnership format, paired with a raft of investment

incentives.

Investors

are being welcomed to 11 newly planned industrial clusters (ICs) covering

283.5 hectares, focusing on seven locations in the province, namely the city

of Song Cong, Pho Yen town, and Dong Hy, Dinh Hoa, Phu Binh, Phu Luong, and

Dai Tu districts, according to the Thai Nguyen Department of Industry and

Trade.

The

investors are encouraged to build the ICs under the public-private

partnership (PPP) model to reduce reliance on the state budget.

Significantly, most of the ICs offer convenient transport connections. For

instance, the 48.5ha Ba Xuyen IC (Song Cong) connects to Road 262 and is 18

kilometres from Thai Nguyen’s city centre, while the 20ha Kim Son IC (Dinh

Hoa district) links to National Highway 3C and the Ho Chi Minh Highway.

When

taking part in building these ICs’ technical infrastructure, businesses will

receive financing for 10 per cent of total site clearance costs or 10 per

cent of total investment cost put into building IC technical infrastructure

and wastewater treatment facilities, up to but not exceeding VND6 billion

($265,487) for each IC.

In

addition, in light of the government’s current regulations on land rental and

corporate income tax (CIT) incentives, seven out of nine districts in Thai

Nguyen belong to areas entitled to investment encouragement policies.

Accordingly, these seven districts are subject to a CIT exemption in the

first two to four years and a 50 per cent reduction in the subsequent four to

nine years, depending on their locations.

A

new development, touted as a fresh move in wooing investors to build Thai

Nguyen’s ICs, is that under a decision of the Thai Nguyen People’s Committee,

the Centre for Industrial Promotion and Industrial Development Consultancy

belonging to the Thai Nguyen Department of Industry and Trade was assigned to

act as the developer for building the infrastructure for several ICs,

primarily the 52ha Son Cam 2 IC.

The

move attests to the provincial leadership’s commitment to courting investment

into local IC development.

Centre

director Nguyen Dinh Hung said that the IC investment proposal has been

submitted to the local management authorities for approval and investors are

encouraged to advance their capital for site clearance and building IC

infrastructure.

Economists

say that infrastructure investment plays a vital role in making IC projects

appeal to investors. In fact, despite having detailed plans, many ICs fail to

lure investors due to incomplete investments into infrastructure works such

as power, water, and wastewater treatment.

To

address this bottleneck, Thai Nguyen has reviewed its IC development plan to

remove underperforming ICs and supplement new ICs with favourable locations

and advantages in local labour or natural resources. Seven ICs covering 162ha

were removed from the provincial IC plan and more than 250ha were cut from

five other ICs, while 10 new ICs were added to the plan.

The

Thai Nguyen Department of Industry and Trade has proposed to the Ministry of

Industry and Trade to raise the capital support volume from the central

budget through an industrial promotion programme and has asked the State Bank

of Vietnam to offer concessionary credit packages for investors in ICs

located in remote, mountainous areas.

In

the words of Tran Anh Son, head of the Industrial Management Division under

the Thai Nguyen Department of Industry and Trade, to attract investors, ICs need

convenient access to material supply sources and the consumer market as well

as favourable transport infrastructure.

In

light of Thai Nguyen’s revised IC development plan for 2020 with a vision

towards 2030, the number of local ICs will increase from 32 to 35, covering

1,259ha in total area. Investment will be implemented in two phases. In the

first phase, from now until 2020, efforts will be geared towards building

infrastructure for 28 out of 35 ICs covering 731ha, with an expected

occupancy averaging 60-65 per cent.

In

the second phase, from 2021 to 2030, efforts will be put into finalising the

infrastructure construction of these 28 ICs, matching the detailed IC plan,

striving to reach 100 per cent occupancy, and building infrastructure for the

remaining seven ICs covering more than 202ha.

The

province is set to raise $79.6 million in total investment capital in the

first phase and $98.9 million in the second, with the amount sourced from the

non-state budget to surpass $44.2 million in each phase.

Second edition of HortEx Vietnam set for March 2019

The

2nd International Exhibition and Conference for Horticultural and

Floricultural Production and Processing Technology (HortEx Vietnam) will take

place at the Saigon Exhibition and Convention Center (SECC) in Ho Chi Minh

City from March 13 to 15, 2019.

Topics

demonstrated via presentations include “Vietnam - Overview of the

Horticultural and Floricultural Industry” by the Ministry of Agriculture and

Rural Development (MARD); “Business Opportunities between Thai and Vietnamese

Enterprises” by the Vietnam Fruit and Vegetable Association (Vinafruit); and

“Experience Sharing on Doing Horticultural and Floricultural Business in

Vietnam” by Thai companies.

HortEx

Vietnam is the only international exhibition and conference for horticultural

and floricultural production and processing technology in Vietnam. It was

held for the first time in this year by the Minh Vi Exhibition and

Advertisement Services Co. from Vietnam, with the Netherlands’ Nova

Exhibitions BV as co-organizer.

The

first edition attracted 110 participants from 20 countries and welcomed 4,530

trade visitors. Besides Vietnamese visitors the exhibition also welcomed a

large number of visitors from overseas, such as Cambodia, Thailand, the

Philippines, Taiwan, South Korea, Australia, China, the US, and India.

HortEx

Vietnam 2018 received a great reception from exhibitors, with 92 per cent

saying it met their expectations. Based on positive feedback and growing

interest in the Vietnamese market, the decision was made to increase the

exhibition space by two-fold for this next edition in order to meet the

increasing demand from companies worldwide.

HortEx

Vietnam aims to support the rapid growth of the Vietnam’s horticulture and

floriculture industry. According to figures from MARD, horticulture and

floriculture production and processing is one of the most promising segments

in the country.

Vietnam

earned over $2.3 billion from exporting fruit and vegetables in the first

seven of 2018, a year-on-year rise of 12.6 per cent. Horticulture and

floriculture are set for steady growth and to become a leading export

industry in Vietnam.

HortEx

Vietnam has received strong endorsement from MARD, the Lam Dong Tourism,

Trade and Investment Promotion Center (TIPC), Vinafruit, the Dalat Flower

Association, and the Embassy of the Netherlands in Vietnam. The event is

anticipated to connect worldwide providers with local businesses and experts

from related industries in Vietnam.

Nearly 2,000 new FDI projects licensed in 8M

There

were 1,918 new FDI projects granted investment licenses in the first eight

months of 2018, with total newly-registered capital of $13.48 billion, up 736

projects and 0.2 per cent over the same period of 2017, according to the

Foreign Investment Agency (FIA) at the Ministry of Planning and Investment.

Additional capital totaled $5.58 billion, or 87.2 per cent of the figure in

the same period last year.

Total

new and additional capital and share purchases by foreign investors was

$24.35 billion, up 4.2 per cent.

FDI

projects had disbursed $11.25 billion as at August 20, a 9.2 per cent

increase.

Manufacturing

and processing attracted the most attention from foreign investors, with

total capital of $10.72 billion, accounting for 44 per cent of all registered

capital.

Real

estate followed, with total capital of $5.9 billion, accounting for 24.2 per

cent. Third was wholesale and retail, with $1.87 billion, or 7.6 per cent.

Japan

was the largest investor in the period, with total capital of $7 billion,

accounting for 28.8 per cent of all capital, followed by South Korea with

$5.16 billion and Singapore with $3.47 billion.

Foreign

investors invested in 59 of Vietnam’s cities and provinces, in which Hanoi

attracted the most, with $5.93 billion, or 24.4 per cent, then Ho Chi Minh

City with $4.42 billion or 18.2 per cent and Ba Ria Vung Tau with $2.17

billion or 8.9 per cent.

PVN may postpone divestment of PV GAS to 2020

The

State-run Vietnam Oil and Gas Group (PetroVietnam, or PVN) previously planned

to reduce its ownership in PV GAS from 95.76 per cent to 65 per cent in the

2018-2019 period, under Document No. 1182 / TTg-DMDN on approving a list of

enterprises belonging to PVN to be restructured, equitized, or divested in

the 2017-2020 period.

It

recently, however, sent an official letter to the Ministry of Industry and

Trade on supplementing and finalizing its restructuring plan for the

2017-2025 period, including the divestment from PV GAS. The group will

actively consider the time of divestment from now until 2020. For the moment,

it will focus on withdrawing capital from subsidiaries such as PV Drilling

(PVD), PetroVietnam General Services (PET), PetroVietnam Engineering (PVE),

and the PetroVietnam Drilling Mud Corporation (PV-DMC).

PV

GAS is a leading company at the top of the listed market. When oil prices

declined in the 2015-2017 period, despite earning lower profits, PV GAS

always paid a cash dividend of 40 per cent of charter capital, outlaying

VND7.5 trillion ($322.1 million).

State

capital withdrawal in the 2018-2019 period is 30 per cent of PV GAS’s charter

capital, equivalent to 587 million shares. At a current price of VND100,000

($4.3) per share, the transaction could reap VND58.7 trillion ($2.5 billion).

Post-divestment,

PVN will still have a controlling interest in GAS but 30 per cent is a

significant holding for strategic investors, according to local insiders. Any

sale is expected to attract many foreign investors, similar to what has been

seen in the divestment of Vinamilk and Sabeco.

Leaders

at PV GAS expect that, this year, the company will look for opportunities to

cooperate more deeply with shareholders, especially strategic investors.

It

posted revenue of VND37.45 trillion ($1.6 billion) in the first half of this

year, representing 66 per cent of the annual target, and pre-tax profit of

VND6.6 trillion ($283.4 million), or 82 per cent.

PHI Group partners with Hanoi MHD Invest

PHI

Group, Inc., a diverse holding company from the US focused on merger and

acquisitions (M&A) and investments in natural resources, energy,

agriculture and special situations, has signed a memorandum of understanding

with the Hanoi MHD Invest JSC over real estate investment and development

activities in Vietnam.

“As

we continue to focus on number of key long-term programs in Vietnam, we are

delighted to have MHD as our partner in the real estate investment and

development sector,” said Mr. Henry Fahman, Chairman and CEO of PHI Group.

“We are highly impressed with MHD’s talented, professional and disciplined

management and look forward to building a mutually rewarding association that

will contribute to a new phase of growth and expansion for both companies and

beyond.”

PHI

will assist MHD to become a publicly-traded company in the US and/or

international stock markets. It will engage with the Vietnamese partner in

the execution of building projects, including but not limited to the

under-consideration Asia Diamond Exchange in the Free-trade Section of the

Chu Lai Open Economic Zone in central Quang Nam province.

The

two will also cooperate in the establishment of and investment in a real

estate sub-fund under the master Reserved Alternative Investment Fund (RAIF)

set up by PHI in accordance with the Luxembourg Institutional Bank Fund Laws.

It is expected that the size of the real estate sub-fund will increase

substantially over time to meet the growing needs of investment and

development in Vietnam’s real estate market. MHD and PHI will cooperate to

jointly develop and implement various real estate projects in Vietnam.

They

will also coordinate with international partners to develop and provide

innovative construction materials with new technologies to Vietnam and other

Southeast Asian markets. MHD and PHI will cooperate to finance or invest in

other third-party real estate and hospitality projects in Vietnam as

opportunities arise.

“We

are very pleased to partner with PHI Group on a comprehensive basis to

participate in the development of the real estate sub-fund as well as other

business opportunities that can capitalize on our expertise and experience to

create significant value for stakeholders that would otherwise not be

possible,” said Mr. Tung Thanh Nguyen, Chairman and General Director of MHD

Hanoi Invest.

MHD

has an excellent track record and vast experience in the fields of

construction, project management, and real estate investment and development

in Vietnam and is currently building two 40-story towers in Hanoi, among

other prominent projects.

PHI

Group was instrumental in taking the first Vietnamese company public on the

US Stock Market in the past (i.e. Cavico Corporation, which used to be listed

on Nasdaq), and is currently engaged in the areas of agriculture, renewable

energy, real estate, consumer goods, and M&A in Vietnam. It will assist

in taking MHD public in the US Stock Market and creating a platform for MHD’s

growth and expansion in the future.

VNN

|

Thứ Bảy, 1 tháng 9, 2018

Đăng ký:

Đăng Nhận xét (Atom)

Không có nhận xét nào:

Đăng nhận xét