|

BUSINESS IN

BRIEF 8/4

Vietnamese fresh coconut consumed in US

At

present, exporter Vina T&T in Ho Chi Minh City exports around 500,000

fresh coconuts to the US every week.

There

has been rising demand for fresh coconuts in the global markets

including South Korea, Canada, Australia especially the US. Fresh coconut

water is favored by American consumers.

For

years, the US has bought fresh coconuts from Thailand and the Philippines.

Now, the demand is risen drastically, the US importers have placed order for

Vietnamese fruit.

From

July, 2017 to now, the company had exported many batches of coconut to the US

and the fruit received warm welcome from local consumer proving that

Vietnamese fruit is able to improve its competitiveness with their Thai peers

in the US market.

Currently,

Vietnam exports fresh coconut to the US market in two forms; one is canned

coconut and two is whole coconut which outer skin is peeled off.

Price of Vietnamese fruit exports on upward trend

The

Ministry of Agriculture and Rural Development said that prices of fruits have

risen due to buoyant market demand.

White

flesh dragon fruit is sold at VND15,000 per kilogram while red flesh dragon

fruit fetches VND40,000 a kilogram ($1.75) at gardens.

Price

of Thai jackfruit grown in the Mekong delta is up at VND4-,000-50,000 a

kilogram, doubling same period last year. The price of jackfruit reaches an

all-time high.

Before,

China traders just bought canned jackfruit; however, they even buy the whole

fruit at present.

The

Department of Agriculture and Rural Development in Tien Giang Province in the

Mekong delta said that the first-class jackfruit fetch over VND40,000 a

kilogram at gardens and VND60,000 at markets.

Bananas

are sold at VND15,000 and VND18,000 a kilogram in gardens and markets

respectively, much higher than last year ( at VND1,000 per kilogram). Because

of shortage of banana for export, prices of banana have risen higher.

Star

apple fluctuated from VND18,000 to VND20,000 in Tien Giang Province, around

VND5,000 higher than year-ago period.

According

to the Ministry, prices of vegetables in the central highlands province of Lam

Dong and in northern provinces were on downward trend in March.

Potatoes

are sold at VND10,000- VND11,000 a kilogram for the first kind, onion at

VND3,000 a kilogram, an four time decrease compared to before the Tet holiday

( the Lunar New Year in February 15).

Carrot

also went down from VND25,00 to VND20,900 a kilogram, white cabbage from

VND11,500 to VND9,500. Turnip and kohlrabi fetched VND1,000 in the northern

province because abundant supply thanks to good weather.

MIT not to recognize cryptocurrency as means of payment

The

Ministry of Industry and Trade of Vietnam (MIT) yesterday issued a press

release relating to apply of retail prices for electricity consumers who have

automated computer data processing systems serving for cryptocurrency

decoding operations.

According

to the State Bank of Vietnam and the Ministry of Justice, the usage of

electricity for the purposes of automatic data processing serves to decode

cryptocurrency such as bitcoin, litecoin, ethereum and some other similar

currencies not being in subject to the Decree No. 101/2012/NĐ-CP dated on

November 22, 2012 of the Government on non-cash payment and Decree No.

80/2016/NĐ-CP dated on July 1, 2016 of the Government amending and

supplementing some articles of Decree No. 101/2012/NĐ-CP.

However,

the above activities are also not banned in electricity activities and the

usage of electricity stipulated in Article 7 of the Electricity Law of 2004,

amended and supplemented in 2012.

On

the basis of the opinions of the State Bank and the Ministry of Justice, the

Ministry of Industry and Trade issued a document No. 1402/BCT-ĐTĐL guiding

the implementation of the electricity selling price.

Accordingly,

electricity used for decoding and exploiting cryptocurrency activities is

subject to the retail price of electricity for business purposes. The

Ministry of Industry and Trade did not recognize cryptocurrency as currency

or means of payment.

U.S. firms seek to invest in Danang real estate

More

than 40 enterprises from the U.S. sought investment opportunities in the real

estate sector in Danang City at an investment forum held in the city on April

2.

The

Danang – U.S. Investment Forum was jointly held by the Danang Investment

Promotion Agency (IPA Danang) and the Vietnamese National Association of Real

Estate Professionals (VNARP) in the U.S., with an aim to help enterprises

sound out investment opportunities and forge partnerships. In addition to 40

U.S. companies, the forum was attended by 25 real estate firms in Danang.

At

the forum, a representative of U.S.-based Keller Williams Silicon City, a

member of VNARP, asked the Danang City government to allow the company to

study and invest in a 500-hectare complex providing education, leisure and

healthcare services in Hoa Vang District.

Keller

William Silicon City has earlier inked a cooperative agreement with Danang

Construction Material and House - Building JSC to develop some components of

the project.

Hilda

Ramirez, CEO of Keller William Silicon City, said she was impressed by

Danang’s rapid growth, especially in the resort sector. She and some overseas

Vietnamese businessmen have plans to return to Vietnam in the coming time for

investment in Danang.

Some

U.S. companies are interested in projects that the Danang government is

calling for investment in and incentives offered by the Danang Hi-Tech Park

(DHTP). Jonathan George Hanhan, senior vice president of CSR Commercial Real

Estate Service, said his company is interested in the Silicon Valley project

in DHTP.

Huynh

Duc Tho, chairman of Danang, said the city is promoting investment in tourism

and information technology, which have much room for real estate investment.

IPA

Danang and the Danang Department of Construction will do their best to

support U.S. firms, Tho said, adding that DHTP is offering the best tax

incentives in Vietnam.

In

addition to learning more about the investment environment in Danang,

overseas Vietnamese businessmen also called on Vietnamese businesses to

penetrate the U.S. real estate market.

Evan

Phong Huynh, executive director of D1 Gateway for Silicon Valley, called on

Vietnamese enterprises to invest in the company’s project to develop a US$100

million complex gathering Asian businesses in the Silicon Valley.

Lieu

Nguyen, member of the Northern Virginia Association of Realtors, said

Virginia and Washington D.C. are the promising land for Vietnamese real

estate developers.

According

to Michael Q. Le, general director of Robert Mullins International, the U.S.

investment policies have become more favorable for Vietnamese investors. As

president of the Thua Thien-Hue Union of Friendship Organizations in the

U.S., he pledged to support Vietnamese enterprises to do business in the U.S.

The

Danang – U.S. Investment Forum is part of the Vietnam trip that will last

until April 6 of a U.S. business delegation. After the forum, the U.S.

businesses would visit Quang Nam Province.

At

present, there are 52 projects invested by U.S. firms in Danang, with

investment capital totaling more than US$518 million, accounting for over 16%

of the city’s total foreign direct investment (FDI). U.S. firms mainly invest

in real estate, finance, trade, tourism, education and hi-tech sectors.

Vietnam manufacturing growth slows in March

Business

conditions in Vietnam’s manufacturing sector continued to improve at the end

of the first quarter of 2018, although the rate of expansion eased from that

seen in February.

According

to a Nikkei report released on April 2, the Vietnam Manufacturing Purchasing

Managers’ Index (PMI) eased to 51.6 in March from February’s 10-month high of

53.5. The reading signaled a modest improvement in the health of the sector

and that was the weakest since November last year.

Business

conditions have now strengthened in each of the past 28 months. March data

signaled a slight monthly rise in manufacturing output but it was the slowest

in the current four-month sequence of expansion.

Andrew

Harker, associate director at IHS Markit, which compiles the survey, said

that although remaining in growth territory in March, the Vietnamese

manufacturing sector saw a softer expansion, particularly with regard to

output.

New

orders continued to rise solidly amid a strong export performance, providing

some optimism that output will continue to rise in the near future.

Besides,

there was some respite for companies on the inflation front, with input costs

increasing at a much slower pace than was seen in February. It looks,

therefore, that inflationary pressure may have peaked around the turn of the

year, Harker said in the report.

The

rate of growth in new business also eased, but remained solid amid reports of

improved client demand. The rise in overall new orders was supported by a

faster increase in new business from abroad, the most marked since last

October.

Slower

new order growth enabled firms to work through outstanding business again in

March. The rate of depletion accelerated to the strongest for three years.

Manufacturers

raised their staffing levels for the 24th successive month in response to

higher output requirements. However, the rate of job creation eased to a

seven-month low.

Although

input prices continued to rise sharply in March, the rate of inflation eased

markedly from February and was the slowest since August 2017. Where input

costs increased, this was linked to higher market prices.

Output

price inflation also eased amid competitive pressures. Selling prices have

now risen in each of the past seven months.

In

line with the picture for output and new orders, purchasing activity rose at

a weaker pace during March. The increase was still solid, however, extending

the current sequence of growth to 28 months.

Inventory

holdings were broadly stable during the month. Stocks of purchases were

little changed following three months of expansion, while stocks of finished

goods stabilized after eight months of decline.

In

addition, panelists indicated that slower increases in output and new orders

led to caution around stock holdings.

Manufacturers

were strongly optimistic that output will increase over the coming year, with

sentiment rebounding from February’s eight-month low. More than 55% of

respondents forecast output to increase.

Govt launches credit guarantee fund for SMEs

The

Government has issued a decree on establishment, organization and operation

of credit guarantee funds for small and medium-sized enterprises (SMEs),

VnEconomy newspaper reports.

Under

Decree 34/2018/ND-CP, each credit guarantee fund is a State financial

organization established by a provincial government. It is operated as a

non-profit institution which underwrites credits for SMEs in line with this

decree and other prevailing regulations.

Each

fund runs under the model of a one-member limited liability company whose

chartered capital is wholly held by the State.

The

requirements for establishing a credit guarantee fund include its chartered

capital of at least VND100 billion (US$4.3 million), a fund establishment

scheme approved the provincial people’s council, its organization and

operation charter, and a list of its key members such as chairperson,

supervisor, director, deputy directors, and chief accountant.

SMEs

that are established in accordance with the SME Support Law and its guidance

documents, and have potential for growth but have yet to meet the

requirements for bank loans are given priority to receive credit guarantees

from the fund in line with this decree.

Those

SMEs should have sound investment projects and production and business plans,

and have the ability to repay their loans. Besides, such enterprises should

not have tax debts overdue for one year in line with the Tax Management Law,

and should have settled their bad debts owed to credit institutions.

A

credit guarantee fund will then evaluate their projects and plans to have the

final say in its guarantee decision.

The

number of SMEs has risen sharply compared with that of large-scale

enterprises, according to the preliminary data of the 2017 general economic

census conducted by the General Statistics Office of Vietnam.

Vietnam

has over 10,000 large companies as of early 2017, a 29% rise against 2012.

They accounted for a mere 1.9% of the total. Meanwhile, the respective

numbers of micro, small and medium-sized enterprises rose by 65.5%, 21.2% and

23.6% against 2012, making up a whopping 74% of the total.

Investor caution advised in April

Securities

experts have advised investors to stay cautious this month as the stock

market has been dependent on a number of large caps while turnover has ebbed

sharply recently.

Although

the VN-Index of the Hochiminh Stock Exchange has grown swiftly since early

this year, the trend has relied merely on some large caps such as GAS, VIC,

VNM and VJC. In the past sessions, bank stocks have experienced sluggish

trading after their strong rallies.

Trading

value has been shrinking while foreign investors, especially exchange traded

funds, have switched to the sell side. In general, the market has yet to see

new index drivers that are able to replace bank stocks, securities expert

Nguyen Huu Binh is quoted by tinnhanhchungkhoan.vn as saying.

Currently,

investor sentiment is still supported by good company earnings in the first

quarter and annual general meetings by large enterprises. However, global

stock markets are tumbling, thus leaving negative impact on Vietnamese

equities.

Given

the lack of market drivers, the main index is likely to drop to 1,100 points

in the first two weeks of April. Otherwise, it could hover around 1,150 or

1,200 points if key stocks do not perform better, the expert said.

Dang

Thanh The, strategy director at KB Vietnam Securities Company, said the

VN-Index advanced early last month, buoyed by large-cap stocks and those in

the banking, securities and property sectors. However, only heavyweights were

able to maintain gains in the second half of March.

Therefore,

the domestic market may see some volatility this month as global markets have

tumbled, The predicted.

The

VN-Index jumped to new highs, closing up 0.63% last Friday. For the week, the

index added 1.9%, marking the seventh week of gains in a row.

For

the month, the market increased 4.6% for a seventh consecutive month. In the

January-March period, the index soared 19% on top of the 22% surge in the

last quarter of 2017.

Leading

gas group GAS was the top contributor to the day’s gains as the price of

Brent crude oil rose to above US$69 per barrel in Asian trading. Other

energy-related stocks also gained to help narrow their losses for the week,

such as PVD and PVS.

Among

the top performers in the first quarter were property firm VIC, consumer

goods producer MSN and jewelry enterprise PNJ.

VEPR proposes lifting VFA’s monopoly over rice trade

The

Vietnam Institute for Economic and Policy Research (VEPR) has proposed doing

away with the Vietnam Food Association’s (VFA) monopoly over rice trade to

support domestic rice production.

VEPR

and the Agriculture Coalition organized a conference to assess the role of

VFA in Vietnam’s rice industry and make recommendations to reform the

association.

VFA

just protects the interests of a few big businesses only, VEPR said. The

stringent requirements provided in Government Decree 109/2010/ND-CP

effectively disqualify small private traders from VFA membership.

The

rice export requirements are based on scope of rice production and location

of trade, so small firms which rely on niche markets for value-added rice

varieties cannot qualify for VFA membership.

This

shows VFA does not represent small traders and farmers, said Nguyen Duc

Thanh, head of VEPR.

VFA

has been given much power, especially at a time when there is a rice

oversupply and rice export is becoming an important lifeline for domestic

producers.

VFA

has monopoly over rice export quotas and government-to-government rice

contracts while enterprises and localities are responsible for purchasing

rice from farmers and storing the food staple.

Vo

Hung Dung, former director of the Can Tho branch of the Vietnam Chamber of

Commerce and Industry, said many enterprises that formerly opposed VFA’s

monopoly over rice trade are supporting such monopoly now that they are VFA

members.

According

to Le Duc Thinh, vice head of the Department of Cooperatives and Rural

Development under the Ministry of Agriculture and Rural Development, said VFA

used to play a role in supporting rice traders to penetrate foreign markets.

However, the Government is scaling down the role of State-owned enterprises

and recognizing private companies as a driving force of the rice industry.

He

said the Government should revise or lift Decree 109 that protects VFA’s

monopoly.

Vietnam to ship 300,000 tons of rice to Indonesia

Vietnam

has won a contract to sell 300,000 tons of 15% broken rice to Indonesia,

which will fuel rice export activity in the near future. Indonesia needs to

import 500,000 tons of rice this time.

Nguyen

Ngoc Nam, chairman of the Vietnam Food Association (VFA) and acting general

director of Vietnam Southern Food Corporation (Vinafood 2), told the Daily

last Saturday this is the third Indonesian rice purchase from abroad this

year after a two-year interruption.

Lam

Anh Tuan, director of Thinh Phat Co Ltd which is a VFA member, confirmed the

information with the Daily, saying Vietnam Northern Food Corporation

(Vinafood 1) and Vinafood 2 have won the contract.

Unlike

before, Indonesia did not invite tenders but directly negotiated with rice

exporting firms before signing contracts.

Delivery

in the new Indonesian rice contract will start from May and end in July. The

price is not disclosed but Tuan said it is reasonable. However, a source told

the Daily that it is around US$465.9 per ton.

The

current local rice price is over US$410 a ton, so the Indonesia deal will

help spur prices for future contracts. Before the signing of the contract,

some rice importing countries declined to buy rice from Vietnam as they said

Thailand offered lower prices, Tuan said.

Indonesia

will buy the remaining 200,000 tons from Thailand at US$473.8 per ton.

Earlier

this year Indonesia imported 141,000 tons of rice from Vietnam, 120,000 tons

from Thailand, 65,000 tons from Pakistan and 20,000 tons from India. Later it

bought 50,000 tons from Pakistan.

Thus,

Indonesia has imported some 895,000 tons of rice including 441,000 tons from

Vietnam.

Vietnam, China to launch freight railway

Vietnam

and China are working on a plan to open a freight train service between

Vietnam’s capital of Hanoi and China’s city of Chongqing, according to the

Ministry of Transport.

Deputy

Minister of Transport Nguyen Van Cong last week met with Liu Guiping, deputy

mayor of Chongqing City, to discuss traffic connectivity between the two

countries.

Liu

said Chongqing has expressway, railway, airway and waterway facilities and

that its waterways can be connected to seaports in Haiphong City and HCMC in

Vietnam.

Last

year, more than 2,600 tons of cargo worth over US$52.5 million was

transported from Chongqing to Vietnam by land. Cargo transport by train was

even smaller as it is time-consuming.

In

a recent trial run, it takes the Chongqing-Hanoi freight train 99 hours to

complete its journey, including 30 hours for customs clearance.

Liu

believed freight train service holds growth potential as it can carry a huge

volume of cargo.

He

proposed the Ministry of Transport coordinate with Chongqing government to

launch the rail service connecting Chongqing and Pingxiang in China and

Vietnam’s Dong Dang and Hanoi. The railway will be connected to the rail link

between Chongqing and Central Europe.

Deputy

Minister of Transport Cong said the ministry has plans to build a

140-kilometer expressway linking Tra Linh border gate in Cao Bang Province

and Thai Nguyen Province, which will be in turn linked to Thai Nguyen-Hanoi

Expressway to facilitate cargo transport between Hanoi and Chongqing.

Last

year, 453,500 tons of cargo was transported from China to Vietnam, 387,600

tons in the opposite direction and 825 tons in transit in China for export to

a third country. The volume remains modest, so the ministry agreed with

Chongqing’s proposal for enhancement of railway connectivity.

The

ministry has also mobilized resources to build logistics centers to reduce

transport costs.

The

two sides agreed to exchange information, promote connectivity and organize

exhibitions and fairs featuring the Hanoi-Chongqing freight railway.

Cong

emphasized that the ministry is ready to work with relevant ministries and

agencies in Vietnam to simplify customs procedures and connect transport,

logistics and trade firms from the two countries, promoting cooperation in the

railway sector.

HCMC budget revenue put at VND90 trillion in quarter one

The

HCMC government has posted budget revenue of VND90.83 trillion (US$3.9

billion) in the first quarter this year, up 2.47% against the same period

last year, according to a city report.

The

central Government has asked the city to collect VND376.78 trillion this

year, or an average of VND1,203 billion a day. The report says the

quarter-one amount has met 24.1% of the full-year goal.

The

city forecast that its budget revenue is expected to further grow while its

socio-economic growth will remain sustainable.

Corporate

income and value-added taxes in quarter one are estimated to rise 11.43% and

11.47% respectively over the year-ago period. Meanwhile, budget revenue from

import and export activities is down 6.8% year-on-year to VND23.4 trillion.

The

city government said in the report that the fall is mainly due to Government

Decree 116 on auto manufacture, assembly, import, maintenance and warranty

services, and Government Decree 156/2017/ND-CP on Vietnam’s special

preferential import tariffs in the ASEAN Trade in Goods Agreement for

2018-2022.

Cars

of less than nine seats which are imported from the ASEAN are subject to zero

import tariff, thus affecting the city’s tax revenue.

Vietnam

has joined multiple free trade agreements, which will lead to strong falls in

tax revenue, the brunt of it to be borne by HCMC as the country’s economic

center.

Vietnam exports to China, S.Korea surge in Q1

Vietnam’s

exports to key markets, especially China and South Korea, have grown sharply

in the first quarter of the year, according to a report by the General

Statistics Office.

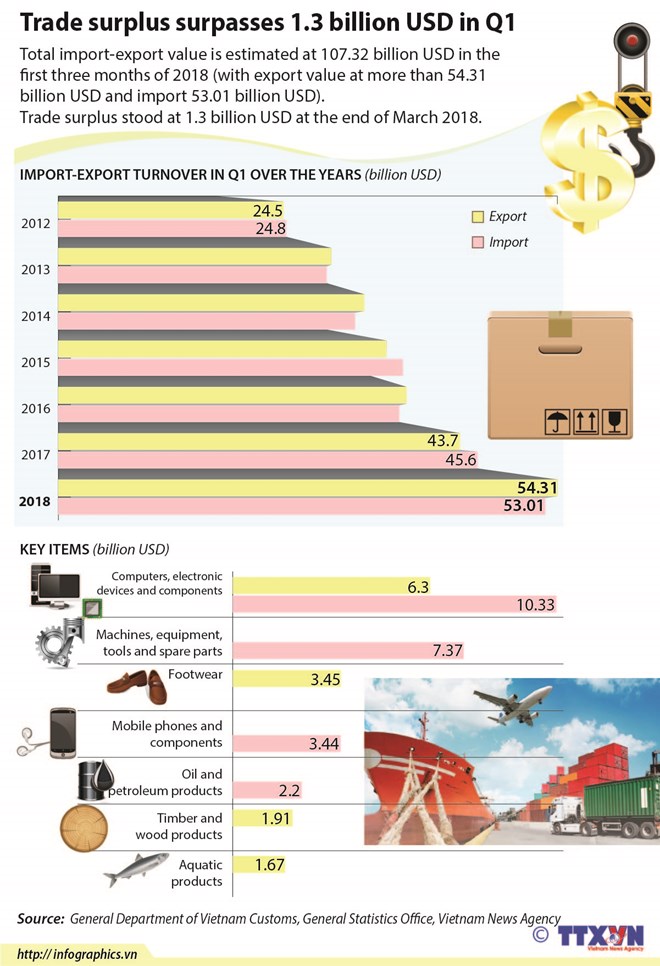

In

January-March, Vietnam has exported US$54.31 billion worth of goods, up 22%

over the same period last year. Of which, domestic firms have contributed

US$14.97 billion and foreign direct investment (FDI) enterprises US$39.34

billion including crude oil, up 18.9% and 23.2% respectively.

China

has spent US$9 billion on imports from Vietnam, up a strong 46% over the

first quarter of last year. Revenues from phones and phone parts, vegetables

and electronics-computers-accessories shipped to the northern neighbor have

surged a staggering 674.4%, 56% and 31.7% respectively.

Meanwhile,

South Korea has imported Vietnamese products worth US$4.3 billion, jumping

35.8%, of which, phones and phone parts have registered export growth of an

impressive 63.5%; electronics, computers and components 59.4%; and

textiles-garments 12.2%.

However,

the EU is Vietnam’s biggest importer with US$9.8 billion in quarter one, up

19.7% year-on-year. In particular, shipments of phones and phone parts to the

EU have edged up 33.6%, and those of electronics, computers and accessories

have inched up 13.9%.

The

U.S. comes second with US$9.6 billion, an increase of 11.6%, with footwear

shipments growing 19.3% against the year-ago period, textiles-garments 15.4%

and wooden products 9.5%.

Japan

has spent US$4.2 billion buying Vietnamese goods. Vietnam’s sales of

textiles/garments, and vehicles/vehicle parts to Japan have grown 18.8% and

13.9% respectively.

Meanwhile,

Vietnam’s import bill has gone up 13.6% versus the same period last year to

some US$53.01 billion in the period, with local companies accounting for

US$21.26 billion and FDI firms for US$31.75 billion, up 13.4% and 13.7%

respectively. The import value rise would be 12.8% from the year-ago period

if the price hike factor is excluded.

China

has remained the largest exporter to Vietnam, with US$14.3 billion, up 13.7%.

Imports of phones and phone parts from China have grown 30%; machinery,

equipment, tools and accessories 6.8%; and electronics, computers and

components 5.6%.

South

Korea ranks second with US$11.9 billion, up 19%. Vietnam’s imports of

electronics, computers and accessories from South Korea have surged 52.8% and

phones and phone parts 13.6%.

Korea

has enjoyed a trade surplus of US$1.3 billion with Vietnam in the first three

months. Domestic firms have caused a trade deficit of US$6.3 billion while

the FDI sector has registered a trade surplus of US$7.6 billion.

In

January-March, growth in export revenues from some key products of Vietnam

has stayed high over the same period last year such as phones and phone parts

with 58.8%, textiles/garments with 12.9%, and electronics, computers and

accessories with 13.2%, machinery, equipment, tools and spare parts with

22.3%, footwear with 10.9%, and vehicles and accessories with 20.1%.

Some

imports which have grown in the period are electronic products, computers and

accessories with 30.2%, phones and phone parts with 17.2%, fuels with 37.1%

and plastics with 21.5%.

HCA moving towards Industry 4.0

The

HCMC Computer Association (HCA) will foster cooperation with colleges,

businesses and Government agencies this year, with a focus on moving towards

the Fourth Industrial Revolution, or Industry 4.0.

HCA

in coordination with the HCMC Department of Information and Communications

held a meeting on information and communications technology (ICT) on March

28, with ICT businesses and organizations in southern Vietnam attending.

In

2018, HCA and its members will accelerate an ICT human resource development

program, help ICT enterprises out of difficulties, and advise Government

agencies on ICT policies.

HCA

chairman Lam Nguyen Hai Long said HCA will support ICT firms to go global by

penetrating more foreign markets and intensifying international cooperation.

In

addition, HCA will support ICT startups and serve as a bridge connecting ICT

companies in HCMC and domestic and foreign partners.

Vu

Anh Tuan, general secretary of HCA, said HCA will work with the HCMC Union of

Business Associations (HUBA) to organize a conference on IT innovation

featuring nearly 100 ICT firms and join hands with the HCMC Department of

Information and Communications to hold a meeting on how ICT firms can

contribute to smart urban development.

Within

the framework of the meeting, HCA inked a number of agreements on cooperation

in ICT education with many universities and colleges in HCMC such as HCMC

University of Technology (HUTECH), University of Information Technology,

University of Greenwich Vietnam, and Vien Dong College of Advanced Technology.

Particularly,

HCA will join forces with colleges and universities to organize workshops to

update students on new technological trends and knowledge, support the HCMC

startup program, organize ICT competitions, enhance connectivity between

universities and businesses, and support students to visit ICT firms or work

as interns there.

HCA

also signed cooperative deals with Government agencies and ICT businesses.

HCA and the Investment and Trade Promotion Center of HCMC (ITPC) will carry

out ICT investment promotion and facilitation programs and hold dialogues

between ICT firms and city agencies responsible for tax, customs, labor and

social insurance.

Retail sector bracing for new technologies

New

technologies for the retail sector such as virtual reality (VR) and

artificial intelligence (AI) will make their way to Vietnam this year,

especially small and medium enterprises.

At

a press conference on the 2018 Shop & Store exhibition, Nguyen Phi Van,

chairwoman of Retail & Franchise Asia, said most providers of solutions

and technologies for the retail sector have long focused on large retailers

worldwide.

However,

technology firms have begun paying attention to small and medium firms since

the end of last year.

Van

said retailers should make use of new technologies to give consumers a new

shopping experience.

Consumers

at home and abroad have changed their shopping habits, so retailers should

adapt well to meet the demand of consumers. Another reason is that advanced

technologies such as AI and VR have been used in startup projects in the

retail sector.

Retailers

in Singapore and Thailand have adopted new technologies while Vietnamese

peers have lagged behind.

Van

suggested domestic retailers apply appropriate technologies to make shopping

more convenient for consumers.

Suttisak

Wilanan, deputy managing director of Reed Tradex, the organizer of Shop &

Store 2018, said the Vietnamese retail market is growing fast, backed by high

economic growth and changes in shopping habits of local consumers.

As

for the franchise market, international brands have been introduced in

Vietnam and the trend would continue in the next three years as Vietnam is

one of four potential franchise markets worldwide, Van said.

Due

to little experience and information, the Vietnamese franchise sector will

surely face multiple challenges. Regional franchisers have tried to bring

their brands into Vietnam.

Trade surplus surpasses 1.3 billion USD in Q1

Cashew exports surge in first quarter

The

cashew sector enjoyed sharp year-on-year rises in export volume and value in

the first three months of this year at 31 percent and 43.6 percent

respectively thanks to higher quality and price.

In

the first quarter, 73,000 tonnes of cashew were shipped abroad for 739

million USD. In March alone, 26,000 tonnes were exported with revenue of 265

million USD.

The

US, China and the Netherlands remained the biggest import markets with

respective market shares of 30.5 percent, 16.8 percent and 14.3 percent.

Apart

from a fall in the Australian market, all other markets saw an upturn.

However,

Dang Hoang Giang, Vice President of the Vietnam Cashew Association (Vinacas),

said the results do not reflect developments of cashew exports for the whole

year, as higher demand in the Lunar New Year in February sharply impacted

cashew sales in the first quarter.

Along

with the rise in export volume, the price of cashew also increased 12.5

percent over the same period in 2017 to reach 10,261 USD per tonne.

Giang

held there are good signs for cashew prices for the rest of the year.

Meanwhile, Vinacas will increase exports of processed products for higher

added value.

In

the future, cashew export volume may fall, but value will continue rising, he

asserted, adding that total export turnover this year is expected to be equal

to that of 2017 at 3.62 billion USD.

Meanwhile,

according to the Ministry of Agriculture and Rural Development, the country

imported nearly 200,000 tonnes of cashew worth 460 million USD in the first

quarter of 2018, up nearly 20 percent in volume and 33 percent in value over

the same period last year.

Giang

explained that a lot of cashew was imported to Vietnam in the period

following contracts signed in 2017. Therefore, the volume does not reflect

Vietnam’s demand in the period or influence the sector’s targets.

Vibrant Q1 for HCM City’s apartment segment

Ho

Chi Minh City’s apartment segment witnessed high absorption rate in the first

quarter of the year despite the long Tet holiday and abundant supply, the property

service provider CBRE said on April 3.

A

total of 9,260 units were sold during the January-March period, up 4 percent

from the previous quarter and surging 26 percent against the same time last

year. Of the total, mid-end apartments accounted for 65 percent.

In

terms of pricing, the average sales price slightly fell 1.5 percent

quarter-to-quarter while declining 2.6 percent year-on-year to 1,515 USD per

square metre in the primary market. The drop was attributed to the increase

in mid-end apartment supplies in the period.

The

city’s real estate saw the launch of 9,503 apartments, up 11 percent from the

previous quarter and 79 percent from the same period last year. Mid-end

apartments made up 71 percent of the total units offered. The property market

is shifting to meet demands of the buyers and create foundation for a

sustainable development, according to the company.

CBRE

Managing Director Dang Phuong Hang noted that the investors started to roll

out their property market in the first quarter of 2018 after studying the

market in 2017. During the months, they focused on the introduction of new

utilities and safety standards for the residents.

The

retail property segment recorded highest occupancy levels ever. Vacancy rate

in suburb areas remained unchanged with 6.9 percent, down 6.1 compared to the

same time last year.

Total

supply as of the end of the first quarter was 880,940 square metres net

leasable area (NLA).

Rental

price of CBD areas increased 5.4 percent to 121.6 USD per square metre per

month while that of non-CBD areas fell 1.1 percent to 36.4 USD per square

metre per month.

Geographic indication protects unique products

Geographic

indication (GI) is considered an effective way of protecting and adding value

to unique products, and should be used more in Vietnam, experts have said.

GI

designations show that products have specific geographical origin and

qualities or a reputation due to that origin.

GI

is used to protect traditional products whose uniqueness and reputation are

closely linked with the geographical location where they originated.

Speaking

at a seminar in HCM City on April 4, Pham Xuan Da of the Ministry of Science

and Technology said that GI could add value, increase access to new or

existing markets, gain a competitive advantage, and reap more profits. It

also helps fight against misuse or unhealthy competitive acts.

GI

protection preserves biodiversity and develops traditional industries and

tourism sector and help consumers understand the value of the products.

As

of last month, Vietnam has granted protection certificates to 66 GIs, of

which six are from other countries, he said.

Delphine

Marie-Vivien, researcher in intellectual property and food law at CIRAD, a

French research centre specialising in international agricultural and

development issues, said: “The origin of food is important for consumers who

value tradition and cultural identity and who are sensitive to specific

sensorial and organoleptic characteristics of these products. Some consumers

are willing to pay more to find such characteristics in the product.”

Vietnam

drew up a legal framework for GI protection in 1995 under which the State is

the owner of the GI, and has the right to register the GI. It can delegate

the right to producers (both organisations and individuals) and

administrative authorities of the locality.

The

State has the right to manage the use of GI, control and promotion, but it

also can delegate the responsibility to people’s committees in provinces,

districts or cities.

Producers

have the right to use the GI, including organisations and individuals

authorized by the managing authority.

Yet

despite the political will to promote GIs, the use of registered GIs on

products for sale in Vietnam is still limited due to a lack of awareness

among producers and consumers and a lack of interest from local stakeholders

about GI value, as well as the absence of involvement by local authorities in

the promotion of GI and GI products.

Other

issues include lax implementation of quality control and lack of efficient

collective action to manage the GI.

As

a result, it is necessary to overcome the lack of awareness, strengthen

organisation of producers and processors after initial GI registration, and

build up efficient control systems before commercialisation that can help

prevent fraud.

Da

gave Ben Tre province as an example, saying it recently obtained GI

certifications for its grapefruit and Xiem coconuts, which would help

businesses and farmers develop markets for these GI products.

After

successfully obtaining GI certificate, much more efforts are needed to

promote the use of the GI, Da said.

GI

protection had a beneficial impact on economic development in many areas of

the province’s economy, and thus producers should learn about the GI system,

he said.

Tran

Anh Tuan, an expert on market research, said demand for coconut water,

coconut oil, coconut milk and coconut ice cream has increased significantly

in the global market, offering more opportunities for the province to develop

such products.

To

exploit GIs in the most effective way, producers need to “enhance innovation

to come up with better and higher added value products,” he said.

Representing

the province, Le Van Tan, Director of the provincial Department of Science

and Technology, said the province would establish regulations on GI

management and using and grant GIs and revoke the right to use GIs.

It

will also oversee the farming process of GI products and promote GI products

both in domestic and international markets.

Since

its GI coconut products are mainly for export, participants at the seminar said

the province should register to protect its GI products in other countries to

create a solid legal foundation for exports.

The

seminar on the role and impact of GIs in local economic development was

organised by the Vietnamese High Quality Goods Association and the Ben Tre

province People’s Committee on the sidelines of the Vietnamese High Quality

Products Fair in District 11.

Apartments for middle class remain abundant

Apartments

for middle-income people remained hot for consumers, accounting for three

quarters of the total apartments put on sale in the first three months of

2018.

The

information was released at a press conference on Hanoi’s real estate market

in the first quarter of this year held by the Commercial Real Estate Services

(CBRE) Vietnam Company on April 3.

According

to Nguyen Hoai An, Manager of Research, Consulting and Asset Management

Services at CBRE Vietnam, said that in the period, a total of 8,800

apartments of 39 projects were put on sale, with the middle-income segment

making up the majority. The transaction prices ranged from 800-1,500 USD per

sq.m.

During

January-March, around 6,600 apartments were sold, up 5 percent against the

same period last year.

Notably,

foreign investors stepped up the selling at such international markets as

Singapore and China’s Hong Kong.

An

said that the prices of apartments will witness a slight increase of 1-2

percent in the second quarter of 2018.

More

apartment buildings are expected to be built in the outskirts of Hanoi where

transport connectivity is convenient, she added.

She

warned consumers of paying more attention to safety-related issues, including

firefighting, when deciding to buy apartments.

Dak Nong okays 48-mln-USD solar power project

The

Central Highlands province of Dak Nong has approved in principle a solar

power project, worth 1.1 trillion VND (48.4 million USD), in Truc Son

commune, Cu Jut district, the provincial People’s Committee announced on

April 4.

The

44.4-MWp Truc Son solar power plant will be invested by a joint venture of

three parties – Univergy K.K and Europe Clean Energies Japan K.K from Japan

and Thanh Nien Media Corporation from Vietnam.

The

facility will be built on an area of 51 hectares and is expected to be

operational in June 2019 to supply electricity for Dak Nong and neighbouring

provinces.

The

provincial People’s Committee vowed to offer the project preferential tax

rates. It also assigned relevant State agencies and Cu Jut district to

provide support for the investors to implement the project on schedule.

Two

days ago, a German company, BS Heidelberg Solar GmbH, announced to invest in

two solar power projects in the Mekong Delta province of Hau Giang, namely

Hau Giang I and Hau Giang II. The 40MWp and 170MWp plants will be built at a

cost of 50 million USD and 200 million USD, respectively.

Vietnamese

localities are taking measures to attract more investment in renewable

energy, especially solar power.

According

to the Government’s targets, solar power is expected to become the main

renewable energy source in the future, with installed capacity to be

increased from 6-7 MW by the end of 2017 to 850 MW by 2020 (1.6 percent of

the country’s power generation) and 12,000 MW by 2030 (3.3 percent of the

country’s power generation).

Vietnam

is among countries that enjoy the most sunlight in the world, with the

Central Highlands and south central regions recording between 2,000 and 2,600

hours of sunshine every year, reported the Vietnam Clean Energy Association.

Investor

caution advised in April, Price of Vietnamese fruit exports on upward trend,

MIT not to recognize cryptocurrency as means of payment, Govt launches credit

guarantee fund for SMEs

VNN

|

Chủ Nhật, 8 tháng 4, 2018

Đăng ký:

Đăng Nhận xét (Atom)

Không có nhận xét nào:

Đăng nhận xét