|

Banks refuse

government bonds because of low interest rates

Commercial banks

have made a volte face, refusing to buy government bonds because the offered

interest rates are lower than their expected levels.

Government bond sales have been

selling more slowly because commercial banks, the biggest bond buyers, have

turned their back on the bond issuances.

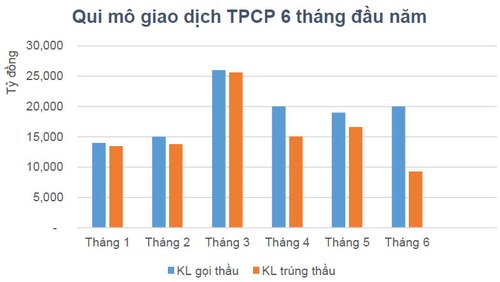

According to Vietcombank Securities

and the Hanoi Stock Exchange, the value of bonds issued on the primary market

in June 2013 was VND11.456 trillion, a sharp decrease of 52.7 percent over

the same period of the last year, the deepest low since November 2012.

The interest rates decreased

continuously in the period from September 2012 to May 2013. In the first five

months of 2013 alone, the interest rates reduced by 2-2.17 percent, which was

equal the interest rate reduction in the whole year 2012. The interest rate

just witnessed a light recovery in June 2013, according to Vietcombank

Securities.

“Cold” and “gloomy” were the words

the securities firm used to describe both the primary and secondary bond

markets last month.

Tong Minh Tuan, Head of the Analysis

Division of Vietcombank Securities, said the market has been quiet partially

because of the foreign investors’ move of withdrawing capital from newly

emerging markets, including

In June 2013, according to Tuan, the

foreigners’ net sales of bonds reached VND5 trillion in value.

In fact, the demand for government

bonds remains high, especially when big banks have profuse capital. However,

the investors expect higher interest rates, according to Tuan.

Ngo Minh Hoa from Bao Viet Securities

has also noted that the amount of government bonds issued has been on the

decrease. Though the number of investors registering to attend the bids

remains high, the number of investors successfully buying bonds is modest.

Hoa believes that commercial banks

and insurance companies would only buy government bonds if the interest rates

reach the expected levels.

Banks once rushed to buy bonds in the

first months of the year, when the interest rates were high. Meanwhile, they

thought the interest rates would decrease towards the end of the year.

“The bond market is always more

bustling in the first months of the year,” Hoa noted.

In general, at the beginning of

years, the bond issuers themselves cannot anticipate the market performance

in the year. Therefore, they tend to issue bonds in high quantities at the

beginning of the year, and then adjust the volume of bonds to be issued in

the next months after considering the market at different moments.

Analysts believe the secondary market

would be more bustling in the second half of the year, when banks need

capital to provide loans to businesses, and they would have to sell bonds for

money.

Tuan also thinks the bond market

would warm up in the time to come, because the credit growth recovers slowly

in the third and fourth quarters, while the banks’ liquidity is strong.

Meanwhile, the bond supply is expected to be profuse, since huge capital is

needed to fund government’s projects.

Short term bonds, 2-3 year bonds,

would be the most favorite, according to Tuan, because bond holders fear long

term risks.

VNE

|

Thứ Hai, 22 tháng 7, 2013

Đăng ký:

Đăng Nhận xét (Atom)

Không có nhận xét nào:

Đăng nhận xét