Internet

price wars on expanding grid

The domestic fibre optic cable

market anticipates a tough race this year between leading players for larger

market share and expanded service provision.

Military-run

telecom giant Viettel just won the rights to develop a fibre optic cable

system for Trang An Complex, a major mixed-use development in Hanoi’s Cau

Giay district.

Under

current regulations, other internet service providers such as leading

state-owned telecom company VNPT and private tech giant FPT can still provide

service upon customer request, but they must pay a fee to Viettel.

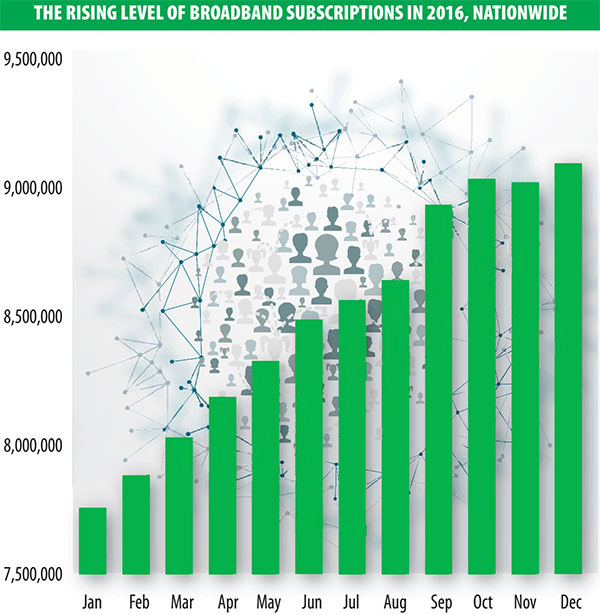

Statistics

released by the Ministry of Information and Communications’ Authority of

Telecommunications showed that subscribers for fixed broadband internet

services (both ADSL and fibre optic) rose from 7.7 million to more than 9.2

million last year – of which fibre optic cable subscribers numbered 5.5

million.

At

the moment, state-owned VNPT leads in internet market share with nearly four

million subscribers (including one million ADSL subscribers), accounting for

41 per cent of total market subscribers.

Viettel,

which owns 500,000 kilometres of fibre optic line, covering 5,170 communes

(46 per cent of communes nationwide), reports more than two million fibre

optic internet subscribers.

These

two players hold about 80 per cent of Vietnam fibre optic cable market share.

The remaining 20 per cent is divided between FPT and other service providers.

During

2014-2015, Viettel was the largest provider of fibre optic cable services in

the country. In 2016, however, they lost ground to VNPT, showcasing the tough

race between these two leading players.

The

race between internet service providers attempting to seize as many

subscribers as possible has led to a gritty price competition.

According

to provider calculations, a monthly fee of VND320,000 ($14.50) per subscriber

will keep them solvent.

In

fact, except for corporate customers who have to pay monthly fees from VND1

million ($45) depending on usage demands, the average fee for family

households ranges from VND200,000-250,000 ($9-11) per subscriber per month.

VNPT

VinaPhone general director To Dung Thai commented that this year will witness

fierce competition between broadband internet services providers in the

context of extremely low average revenue per user (APRU).

The

service providers shared a common assessment that this year the race between

fibre optic cable service providers in expanding their subscriber pool will

move from big cities into rural areas.

A

VNPT source shared that this year the group is set to add 1.2 million new

fibre optic cable subscribers, and to achieve that goal, they will offer

price discounts and try to shorten the time it takes for their services to

reach their customer’s homes.

Accordingly,

VNPT will expand its fibre optic cable coverage to more rural and remote

areas. At present, the group’s fibre optic network covers 93 per cent of

communes nationwide and is expected to reach 97 per cent within 2017.

Viettel’s

strategy is to provide fibre optic packages suited to each customer group at

reasonable fee levels. The group’s goal is to attain 20-25 per cent growth in

fibre optic cable subscriptions this year against last year and expand fibre

optic cable infrastructure coverage to 70 per cent of communes nationwide.

By Huu Tuan, VIR

|

Thứ Ba, 14 tháng 2, 2017

Đăng ký:

Đăng Nhận xét (Atom)

Không có nhận xét nào:

Đăng nhận xét