|

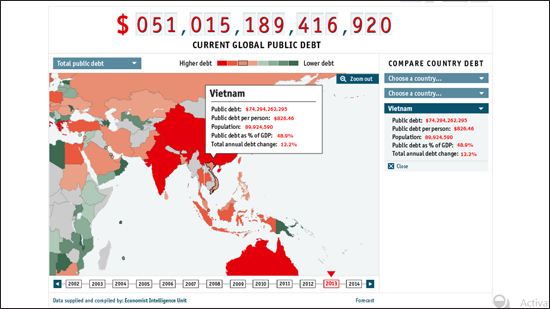

Vietnam’s public debt may reach 95% of

GDP

If counting on

the state owned enterprises’ (SOEs) loans not guaranteed by the government,

the total public debt of

Every Vietnamese

citizen bears the public debt of $90.

How high is

The information can be found in the

report by the macroeconomic policy consultancy team belonging to the National

Assembly’s Economics Committee released on November 22, titled “Thach thuc

con o phia truoc” (challenges are still ahead).

The report showed that by the end of

2012,

However, if counting on the foreign

debts of enterprises, mostly SOEs, not guaranteed by the government, the

SOEs’ bank debts, the debts in bonds, the total public debt of

Under the Public Debt Law, the above

said debts are not counting on as the national public debts. However, the

fact that the government comes forward and guarantees for Vinashin to issue

$600 million worth of international rollover bonds and VND12 trillion worth

of bonds in Vietnam (Vinashion’s loans were not guaranteed in the past) shows

that experts have every reason to give the warning.

Government bond market valued roughly

$10 billion

While the public debt has been

increasing, the cash flow from credit institutions has been running within

the finance system when banks spend money on government bonds instead of

flowing out to the production sector.

The report has pointed out that the

cash flow that got stuck in the system has been used by commercial banks to

buy other valuable assets, such as government bonds or State Bank bonds.

Though the assets bring lower profits, but they are safer.

The primary government bond market’s

scale has been expanding rapidly. The total value of bonds issued and

guaranteed by the government in 2012 was roughly VND200 trillion, or $10

billion. The government issued bonds was VND115 trillion, equal to 85 percent

of that in 2011.

As a result, the capital flow has

been allocated in ineffective way. The capital has been flowing to the public

sector through the government bond issuance, instead of the private economic

sector through the lending to fund production.

This may bring high risks to the

public debts, lead to the dominance of the public investment over the private

investment and may lead to the ineffective allocation of resources. All

analysis works have pointed out that the quality and the productivity of the

private investment deals are far higher than that of public investments.

The state budget expenditure has been

increasing, which explains why the budget deficit in 2012 was still at 4.8

percent (it was 4.7 percent in 2011). The budget deficit ceiling has been

raised to 5.3 percent for 2013.

The report has cited the Asian

Development Bank (ADB) as saying that the Vietnamese bond market has been

growing fastest in the region, which also means the bigger debt payment duty

for

K. Chi,

|

Thứ Hai, 25 tháng 11, 2013

Đăng ký:

Đăng Nhận xét (Atom)

Không có nhận xét nào:

Đăng nhận xét