|

Banks’

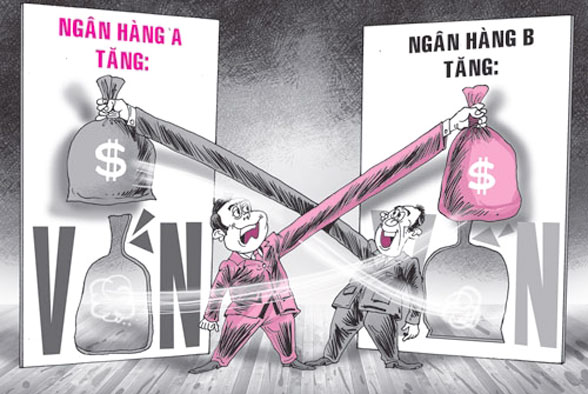

cross-ownership problems remain unsolved

The State Bank

of Vietnam (SBV) has decided that banks’ cross-ownership must end by February

2016. However, according to banking experts, the bank network remains ‘as

interlaced as a spider’s web’.

Under

Circular 36 which was released one year ago, one commercial bank can hold

stakes of no more two other credit institutions, while the stake volume must

be lower than 5 percent of the institutions’ capital. The banks which hold

higher stakes than allowed must reduce the proportion prior to February 2016.

However, the problem still has not been settled as expected by the State Bank. Analysts commented that banks have not implemented the regulation because shareholders don’t want to do it. If they find benefits in maintaining the cross-ownership situation, they will try to maintain the situation. Nguyen Tri Hieu, a renowned banking expert, said owning banks means possessing effective financial tools to finance business projects.

The

current laws set limits on the credit banks can provide to fund one business

project. However, bank shareholders can "play tricks" to dodge the

laws and force banks to which they contribute capital to fund their

investment projects.

Hieu also thinks that as the watchdog agency still does not have measures to seriously sanction violating banks, commercial banks deliberately and slowly reduce their ownership ratios in other banks. Dang Ngoc Duc from the Hanoi Economics University said that instead of commanding banks to cut their ownership ratios in other banks, which he believes is an impossible mission, the State Bank should try to find solutions to deprive them of benefits brought by cross-ownership. If so, banks will give up. Only recently did some commercial banks begin implementing the plan to reduce the cross-ownership ratio. VietinBank recently put 16.9 million Saigonbank shares into auction with the starting price of VND10,800 per share to divest from Saigonbank. Ten individuals (and no institutional investors) joined the auction and ordered a number of shares four times higher than that offered by VietinBank. All the 16.875 million shares were sold to two individual investors at the price of VND12,500 per share on average, which brought VND211 billion to VietinBank. Vietcombank remains the bank which holds the largest capital contributor, holding stakes in four other banks and one finance company. It now holds 7.16 percent of stakes in Military Bank, 8.19 percent in Eximbank, 5.07 percent in Phuong Dong Bank, 4.3 percent in SCB and 10.91 percent in Cement Finance JSC. Analysts said that the reported proportion of stakes held by commercial banks are just the ‘tip of the iceberg’. The real situation is very complicated, and difficult to settle.

DDDN

|

Thứ Tư, 20 tháng 7, 2016

Đăng ký:

Đăng Nhận xét (Atom)

Không có nhận xét nào:

Đăng nhận xét