Understanding Vietnamese wealthy

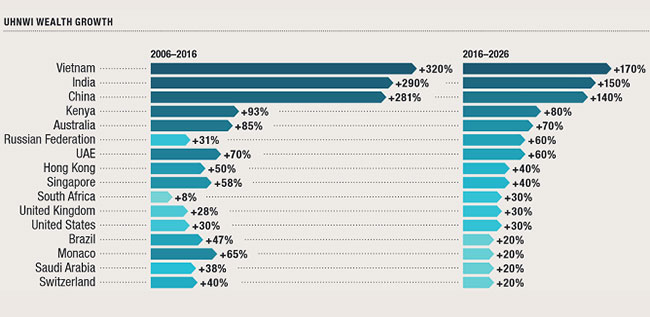

According to the 2016 Wealth Report, Vietnam had 168 super-rich people

(with assets of $30 million and above) in 2015 and the number is going to

increase to 403 by 2025. Seven out of the ten richest people on the Vietnamese

stock market trade in real estates.

There have been some

commentaries from all newspapers. However, these commentaries should look

into the history of Vietnam’s development and these people’s process of

getting rich in order to give an objective account.

Where the wealth comes from

When the country switched

from central planning to a market economy, a part of the population became

rich by selling drugs, prohibited goods, speculation, corruption, or using

their relationship with government officials to enrich themselves and

relatives. These people the government should detect and punish according to

the law.

However, some people took

advantage of the time period to invest in sectors with high profit margins in

order to accumulate initial capital and then use it to expand to other

sectors and form conglomerates.

The owners of many

conglomerates in the private sector got rich from land because they took

advantage of the time when the price of land was very low and the government

was willing to transfer land to the private sector, both domestic and

foreign, pretty easily. When the country became a little more developed

through urbanisation and industrialisation, the price of land rose, making

some people very rich.

It is not right to

attribute this to legal opacity and possible relationship with government

officials.

In the years after the 6th National

Congress of the Communist Party of Vietnam, most of the country was poor.

Local governments issued many policies to encourage investment in the private

sector, including renting out land to investors for free or at very low fees.

Some say these few people

got rich from land, which is public property. This is not really true,

because these people also relied on their own business intuition, in order to

go from the initial capital to become owners of big companies.

Vietnam currently has

600,000 companies in the private sector, of which a few thousand are of a

larger size, and only a small percentage of these got rich from land.

Many rich Vietnamese

people were students who went to study in the USSR (now Russia) and Eastern

European countries or workers who went to work abroad and took advantage of

the transition to a market economy in those countries to amass wealth. Among

these is Pham Nhat Vuong, Vingroup’s chairman. He earned millions of dollars

from producing and selling instant noodles and other fast food in Ukraine and

many Eastern European countries.

Many Vietnamese who live

in the US, Canada, the UK, France and Australia sent billions of dollars to

their relatives in Vietnam and the relatives used this money to invest, or

they themselves set up companies in Vietnam. Many people who worked for

foreign companies returned to Vietnam and used their working experience and

earnings to set up their own companies and have been successful.

Thus, it can be seen that

the rich of Vietnam amassed wealth not only through land but many other ways,

too. However, 168 in a population of 93 million is too few. The Wealth Report

expected this number at 403 by 2025. An increase would be a good thing.

The right attitude would

be to acknowledge the ones that amassed wealth legally and work with law

enforcement agencies to detect and punish those that did so illegally, and

try to narrow the income gap between people.

The real role of the real estate market

In the past 30 years of

Vietnam transitioning from a central planning to a market economy, the

country has made numerous achievements. However, Vietnam is still slow

compared to other countries. South Korea started as low as Vietnam when it

started industrialisation in the mid-60s, but took only 20 years to become an

industrialised country with leading global technology companies, such as

Samsung and LG, but after thirty years Vietnam only succeeded in getting out

of the group of low-income countries. Vietnam also has very few high-tech

companies and its private sector in general has low competitiveness. Labour

productivity is low. The government is trying to fix these weaknesses in the

recently announced restructuring of the economy to follow a new growth model.

Some say that real estate

can help short-term growth but is not a sector that the economy can rely on

for the long term. One cannot ignore the importance of real estate in

economic growth because this sector is an important contributor by being a

significant investment channel, a sector that is directly linked to

urbanisation, housing demand, the technical infrastructure, hotels, offices,

resorts, tourism, the construction material production industry, and

furniture production, not to mention the millions of jobs it creates.

Since the 80s Hanoi only

built between 50,000 and 150,000 square metres of apartment buildings each

year, the old kind, like the ones in Kim Lien and Giang Vo. They are not only

small but also monotonous in design. The tallest hotel was the 11-floor Thang

Long Hotel. In the recent years, Hanoi builds 1.5-1.6 million square metres

annually, with modern architecture. This changes the face of the city. In

1990, the country produced and used 2 million tonnes of cement. In 2016,

these figures were pushing 75 million tonnes produced and 65 million tonnes

used.

Between 2008 and 2012,

the real estate market was at a standstill. Many companies in construction

and real estate sales went bankrupt. Many people became unemployed. Bad debts

rose. Construction material and furniture production companies also met a lot

of difficulties. Eventually, the government had to deploy rescue measures,

including the VND30 trillion ($1.32 billion) loan package for homebuyers.

This shows that the real estate sector is really important.

In Hanoi and Ho Chi Minh

City there are two urban areas built by foreign-invested companies, namely

Ciputra and Phu My Hung. 20 years ago Vietnam was yet to have a big private

company in real estate, so the government let Taiwanese and the Indonesian

firms build these two modern urban areas in the two biggest cities and gave

them many incentives in terms of tax and land rental fees. The developers put

in a few hundred million US dollars in each of these two urban areas, but

then earned a good few times as much. At that point, the government could not

do differently because Vietnamese companies were not yet capable of carrying

out such projects. These projects met the demand for housing and through them

Vietnamese companies learned the tricks of the trade.

Now there are tens of

thousands of real estate developers in Vietnam, including strong companies,

such as Vingroup, Sun Group, Dai Quang Minh, and Novaland, among others. They

have built modern urban areas with complete facilities and claimed the real

estate market as the playground for mostly domestic firms. Only in some cases

where it was necessary did the government give projects to foreign investors

with high technology and capacity, or let the projects be carried out by

cooperation between domestic and foreign companies to increase its quality.

However, it should be

noted that big real estate companies need to invest in technology, design,

architecture, and process too. Some companies have imported modern equipment

and formed a workforce with high qualifications that are capable of designing

and creating modern buildings. These firms then went on to set records in

terms of construction time, while ensuring the quality of the building.

Positive signs

In recent years, many

conglomerates in the private sector expanded operations in many sectors, such

as supermarkets, high-tech agriculture, healthcare, and education. Thanks to

their financial capacity and their experience in business, they produced good

results and earned consumers’ trust. Some five-star hotels in Hanoi, such as

Hilton and Daewoo, used to be joint ventures with foreign companies but have

been bought by Vietnamese private companies.

A Vietnamese that has

made a fortune by selling milk is Thai Huong, chairman of TH Milk. People who

have visited her farm, which is a few hundred hectares in area, where she

grows grass, rears cows, and produces milk, were amazed. In order to carry

out the dream of supplying milk to Vietnamese people, she went to Israel to

learn about the most modern technology, hired a company to advise her on

growing grass, and bought cows from New Zealand and Australia. In less than

10 years, TH Milk has become one of the two dominant Vietnamese milk

companies. It is now in the process of building a project on rearing cows and

producing milk on a gigantic scale in Russia.

Thai Huong said that TH

Milk aimed to have 137,000 cows by the end of 2017, and that its plants have

can meet 50 per cent of the domestic demand for milk through their total

capacity of 500 million litres a year. The Asian Book of Records recognised

the TH farm in Nghia Dan, Nghe An as the biggest concentrated high-tech dairy

farm in Asia.

In 2014 the company

started working with government agencies to supply milk to children in

kindergartens and primary schools in order to improve the height and health

of the Vietnamese populace.

Sapa is one of the most

well-known tourism destinations in Vietnam. Since 2016 the town has a cable

car developed by Sun Group that carries tourists from Muong Hoa to the Fansipan

summit, the highest point of Indochina. The system cost VND4.4 trillion ($193

million). Construction started in November 2013 and the system entered

operation in February 2016. Guinness World Records awarded two Guinness

certifications for the Fansipan cable system, for the biggest height gap

(1,410 metres) between its departure and arrival stations and the world’s

longest three-wire cable car (6,292.5 metres).

This project shows that

Vietnamese companies are now capable to finance and have the skill to

build projects that are complicated both in terms of geography and

technology. The project has contributed to attracting domestic and

international tourists to Sapa and Lao Cai, create jobs for the people there,

and increase local revenues.

Vingroup is a Vietnamese

conglomerate that in the past two years has developed hundreds of

supermarkets across the country, and invested in high-tech agriculture in

many localities. Vingroup has built a supply chain linking producers and

distributors using attractive incentives, and it aims to “connect Vietnamese

companies in each type of product in order to compete with foreign-invested

companies.”

Vingroup has a commission

fee of 0 per cent for some agricultural produce that are sold through its

supermarkets, while Big C has increased this fee to an unbearable percentage

for some Vietnamese companies after it was taken over by Thai investors.

Vingroup has signed a

contract with 250 suppliers and agricultural cooperatives to apply new and

clean technologies, instruct farmers on how to farm, create a low-cost and

fast supply chain for the benefit of producers, companies joining in the

chain, consumers, and Vingroup alike.

Vingroup’s forming a

supply chain, working with producers and distributors, is a model that many Vietnamese

companies in many sectors can learn from. They can create their own supply

chains in order to seize new opportunities from the domestic and global

market.

Many Vietnamese companies

also pay attention to corporate responsibility. They create jobs and set

aside a part of their millions of dollars of revenue to do charity, help

alleviate poverty, support poor households, and give scholarships to poor

students.

Some localities in

Vietnam are blessed with geographical ease of access, so they have better

infrastructure than others. They attract many foreign-invested projects and

see fast socioeconomic growth and are now on the path to modernising

themselves, while mountainous localities and those near the borders have

numerous difficulties in achieving economic growth. This creates a gap

between localities. In recent years many big companies in the private sectors

have invested in highways, urban areas, supermarkets, resorts, and industrial

parks, as well as planted forests, and contributed to narrowing this gap.

These companies helped the government in meeting growth targets at these

localities.

At the investment, trade,

and tourism promotion conference of Tuyen Quang Povince held at the end of

February, some domestic companies registered VND18 trillion ($790 million) in

big projects in the coming years. Prime Minister Nguyen Xuan Phuc said he

appreciated the companies’ efforts and believed that Tuyen Quang is going to

grow faster thanks to the projects.

These prospective

projects include building a 30kilometre expressway linking Tuyen Quang city

with Hanoi-Lao Cai Expressway, reducing the time needed to travel from Hanoi

to Tuyen Quang by 40 per cent. Together with other telecommunication,

electricity, and water infrastructure projects, this will help the locality

better attract foreign investors. The Prime Minister said that the companies

should carry out the registered projects and ensure that all three parties,

namely themselves, the province, and the community can benefit.

Vietnam’s process of

socioeconomic growth is different from other countries’. Therefore, studies

should take into account the different historical context of events in order

to be able to offer correct explanations.

By Professor, Dr Nguyen Mai, VIR

|

Thứ Tư, 22 tháng 3, 2017

Đăng ký:

Đăng Nhận xét (Atom)

Không có nhận xét nào:

Đăng nhận xét