|

M&A

market poised for a turnaround

Despite a slowdown dating from the second half of 2016,

the pace of the merger-and-acquisition market is expected to pick up in the

months to come with many potential deals ahead.

The Japan-invested Daiwa-SSI Fund is on the way to

acquire a 20 per cent stake in Hanoi-based CVI Cosmetic & Pharmaceutical

Co. for an undisclosed sum.

“We are working on necessary procedures to complete the

acquisition by the end of July. The Japanese investment will enable us to

develop a factory in the Hoa Lac Hi-Tech Park,” Phan Van Hieu, chairman of

CVI, told VIR.

Daiwa-SSI’s bid is among the new potential deals for

the second half of 2017, while many others are being negotiated.

At last week’s press conference on the M&A Vietnam

Forum 2017 organised by Vietnam Investment Review and AVM Vietnam, experts

said pharma and healthcare will be among sectors that hold the biggest

appeal for mergers and acquisitions (M&A) in 2017 and 2018, driven by the

increasing population and growing middle class.

“Increasingly deep global integration, through the

signing of free trade agreements and the establishment of the ASEAN Economic

Community, has contributed to making Vietnam more attractive to international

groups and M&A is an effective investment channel,” said Tran Thanh Tam,

director of KPMG’s Markets Group.

One of the most notable M&A deals in the healthcare

sector recently is Quadria Capital, Asia’s leading private healthcare

investor, acquiring a stake in French-Vietnam Hospital in mid July.

Future M&A trends in potential

sectors

M&A Vietnam Forum 2017 experts expect there will be

big M&A deals in the sectors of agriculture, banking and finance,

infrastructure and energy, IT and telecom, education, and pharmaceutical and

healthcare in the coming time.

In the past few years, many leading private firms of

Vietnam have shifted their investments to agriculture. It is forecast that

share issuance for their partners and transfer of stake among investors will

become more popular.

One of the latest M&A deals in the agriculture

sector is Thanh Thanh Cong Tay Ninh Sugar JSC (TTCS) fully acquiring Bien Hoa

Sugar Joint Stock Company (JSC) to become the biggest sugar producer in

Vietnam.

The banking and finance sector is also expected to have

many M&A deals on the back of the sector’s restructuring.

A driving force for this sector is the National

Assembly’s recent adoption of Resolution 42, on piloting the settlement of

bad debts of credit institutions. This resolution’s focus is the resettlement

of guaranteed assets, thus helping better settle bad debt.

“Foreign investors who are interested in the

acquisition of nationalised banks are very concerned about bad debt

settlement prospects. So Resolution 42 will create an incentive for foreign

banks to join Vietnam’s banking restructuring,” said Bui Huy Tho, director of

Management and Licensing for Credit and Banking Activities Department, under

the State Bank of Vietnam (SBV).

Nationalised banks here mean very weak banks that were taken

over by the SBV for zero dong.

“Domestic and international investors are very keen on

buying into Ocean Bank, GP Bank, Vietnam Construction Bank. The SBV has given

them the green light to learn more about these banks before taking further

steps,” he added.

The latest M&A in the banking sector, between

Hanoi-based Vietnam International Bank (VIB) and the Ho Chi Minh City branch

of the Commonwealth Bank of Australia (CBA), happened in early July. In April

this year, ANZ Vietnam also parted with its retail arm, selling to South

Korea-based Shinhan Vietnam.

HSBC Holdings Plc. and Standard Chartered Plc. are also

planning to divest their stake at Vietnamese banks - HSBC’s 19.41 per cent in

Techcombank and Standard Chartered’s 15.69 per cent in ABC, respectively -

after over a decade of being strategic investors with these banks.

With the policy to attract private investment in

infrastructure development, there has been a change in rights for operating

certain infrastructure projects, especially airports and seaports.

France’s Vinci Group is working with state-owned

Vietnam Expressway Corporation, the country’s largest expressway developer,

on the transfer of the operation right for the Cau Gie-Ninh Binh and Ho Chi

Minh City-Long Thanh-Dau Giay Expressways.

In early June, two Japanese expressway companies, East

Nippon Expressway Company (NEXCO) and Expressway International Company Ltd.

(JEXWAY), signed a co-operation agreement with Vietnam’s Foundation

Engineering and Underground Construction JSC (FECON), to buy a 20 per cent

stake in Fecon’s build-operate-transfer project, which includes a bypass road

on National Highway No 1 at Phu Ly and reinforcement work along the road in

the northern province of Ha Nam.

The other sectors that have potential for M&A

activities in the coming time include education, pharmaceuticals, and

healthcare, thanks to Vietnam’s increasing population and disposable income.

In the pharmaceutical market, buyers are looking ahead

to the scrapping of foreign ownership limits (FOL) in the country’s biggest

drug makers, Domesco (DMC), Hau Giang Pharmaceutical JSC (DHG), and Traphaco

(TRA).

DHG has announced that one of the issues it will raise

at the extraordinary annual general meeting this month is the opening of the

FOL to 100 per cent, while TRA is also interested in scrapping its FOL, amid

growing interest from multinational corporations.

Foreign pharma groups see the FOL removal as a positive

signal. A clear path in converting partnerships into majority ownership would

provide companies with much stronger arguments to convince their global

headquarters to invest in Vietnam.

Back in September 2016, when DMC removed its FOL,

US-based Abbott Laboratories increased its stake in the firm to 51.7 per

cent, boosting its footprint in the local pharmaceutical market.

For DHG, if the FOL removal is approved, it will

facilitate Taisho Pharmaceutical Holdings, one of the five biggest drug firms

in Japan, to increase its stake in DHG from the current 24.5 per cent.

In the aviation sector, the Ministry of Transport (MoT)

will seek the government’s permission to continue selling stake in state-owned

Airports Corporation of Vietnam (ACV) – the country’s largest airport

operator – to strategic investors. Europe’s leading airport group Aeroports

de Paris (ADP) is ACV’s foreign strategic partner.

Big potential deals longing for big

pushes

At present, a series of M&A deals are still frozen,

waiting for accelerated equitisation of state-owned enterprises (SOEs) and

investment divestments. If the process gears up, the M&A pace will pick

up.

According to statistics from the M&A Forum (MAF),

Vietnam equitised just 52 SOEs in 2016, or 25 per cent of the 2015 number. In

the first half of 2017, the number was 20 SOEs, equal to 76 per cent of the

same period last year.

“Together with strong competition from regional

countries and a small number of big-scale enterprises, slow equitisation has

caused stagnancy in the M&A market since the second half of 2016,” said

Dang Xuan Minh, general director of AVM Vietnam, vice head of the forum’s

organising board.

In the period, the value of each M&A deal averaged

a lightweight $3-4 million.

“Vietnam’s total M&A value in 2017 cannot surpass

the $5.8 billion of 2016 if there are not big pushes from SOEs and government

policies,” he added.

Foreign investors are waiting for the government’s

decision to buy state stakes in state-owned Sabeco, the largest brewer with

46 per cent market share, and Habeco, the third biggest brewer. The state now

holds an 89.59 per cent interest in Sabeco and 82 per cent in Habeco.

“As expected, Habeco and Sabeco will submit to the

Ministry of Industry and Trade (MoIT) their divestment plans in July. If

approved, the stake sales will be completed within 2017,” said Bui Truong

Thang, vice head of the ministry’s Light Industry Department.

Heineken, AB InBev, SABMiller, Asahi, Kirin Holdings,

Singha, Thai Beverage, and Shingha are queuing up to buy into Sabeco, while

Carlsberg is waiting to buy into Habeco.

In addition, the long awaited equitisations of MobiFone

and Vietnam National Shipping Lines (Vinalines), as well as the divestment of

Petrolimex, attract special interest from international groups and investment

funds.

There is also room for foreign investors to buy into

Vietnam’s biggest dairy company, Vinamilk.

The State Capital Investment Corporation (SCIC),

Vietnam’s sovereign fund, has submitted two options for divesting its stake

in Vinamilk, in which it still holds 39 per cent.

Vinamilk is among the more than 130 companies that SCIC

has to divest from during the 2017-2020 period, according to a government

decision signed on July 10. Vinamilk is a subject of particular interest, as

the local government has asked SCIC to fully exit the $9.8 billion firm.

Consumer goods, retail, and real

estate remain top attractions

In the period from 2014-2018, the M&A market

entered its second wave with a total predicted value of $20 billion, driven

by strong commitments to SOE equitisation, the rise of the private sector,

the country’s deepening global integration, and strong foreign investor

interest.

In 2016, the total value of M&As hit an all-time

high of $5.8 billion, rising 11.92 per cent from 2015. Consumer goods,

retail, and real estate were the most attractive to buyers. Among the

sectors, M&A deals in retail accounted for 38.46 per cent of the total

M&A value.

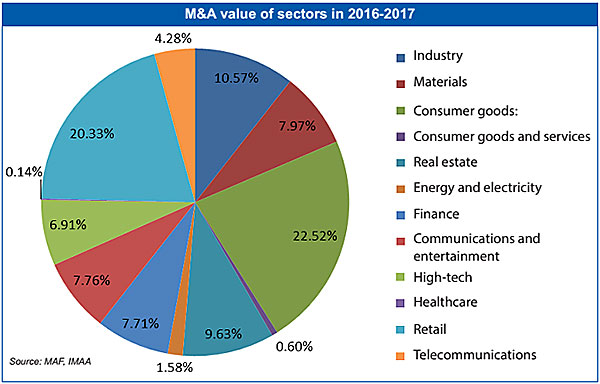

Between 2016 and the first half of 2017, retail made up

20.33 per cent of the total M&A value, followed by consumer goods with

22.52 per cent, and real estate at 9.63 per

cent.

“The majority of M&A deals during the period

focused on the market approach and expansions to cash in on the country’s

young population and rising middle class,” said AVM’s Minh.

Typical examples for this trend were deals made by Thai

groups, including Central Group’s $1.05 billion acquisition of Big C, and the

$800 million Metro Cash & Carry Vietnam deal carried out by TCC Holdings.

Beside retail and consumer goods, real estate continued

to be on the radar of international groups from South Korea, Japan, and

Singapore after a recovery in 2014.

Experts forecast that these sectors will remain the

most attractive in the coming time, thanks to strong local purchasing power.

Asian investors have the upper hand

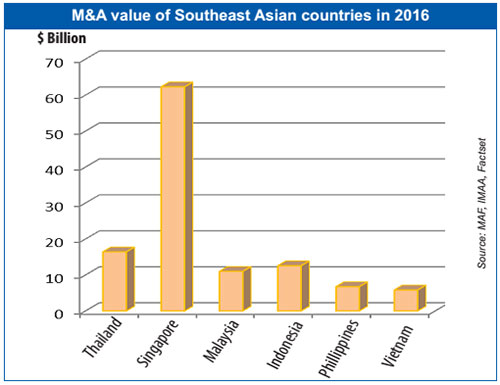

The majority of M&A deals in the $20-100 million

range involved foreign investors, making up 77 per cent of the total M&A

value in Vietnam. Asian buyers, especially those from Singapore, South Korea,

Thailand, and Japan, remained the most active participants.

“M&A deals in Vietnam mostly attracted buyers from

Asia, especially Japan, South Korea, Taiwan, and Singapore. The market is yet

to appeal strongly enough to EU and US investors, due to the smaller scale of

Vietnamese firms,” said Nguyen Quy Lam from the Vietnam Prosperity Joint

Stock Commercial Bank Securities Co., Ltd.

Tam from KPMG said the firm is providing advisory

services for many M&A deals, and most of the buyers are from Asia.

Japan investors focused on aviation, petroleum, and

pharmaceuticals; Singaporeans targeted real estate; the Thai concentrated on

retail;and South Koreans invested in food, banking, and finance.

With the biggest players expected to remain unchanged,

and interest among Japanese and South Korean investors continuing to focus on

retail and consumer goods, the majority of M&A deals should concentrate

on these sectors in the future.

VIR

|

Thứ Ba, 25 tháng 7, 2017

Đăng ký:

Đăng Nhận xét (Atom)

Không có nhận xét nào:

Đăng nhận xét